That is way too much life insurance for a child but it is nowhere near enough for an adult who has his own dependent children. If you have any questions about how the cash value component of a whole life policy works were here to help.

Gerber Whole Life Insurance Review Don T Buy Before You Read 2020

Gerber Whole Life Insurance Review Don T Buy Before You Read 2020

It also cannot grow faster than the face amount of the policy at age 95.

Gerber whole life insurance cash value. Policy holders can choose to receive the cash value as a lump sum or take out a bank loan using the policys cash value as collateral. Guaranteed life insurance is another type of whole life insurance policy that builds cash value. The number to call at gerber life is 1 800 704 3331 to learn more about the grow up plan or to get a quote today.

Under irs tax laws the cash value cannot grow faster than a 7 year worth of payments of a whole life insurance policy. The gerber life guaranteed life plan designed for adults 50 to 80 years old builds cash value that you could borrow against to help pay for medical bills or another immediate need. Some types of life insurance policies including whole life universal life and variable life can accumulate cash value during the policyholders lifetime.

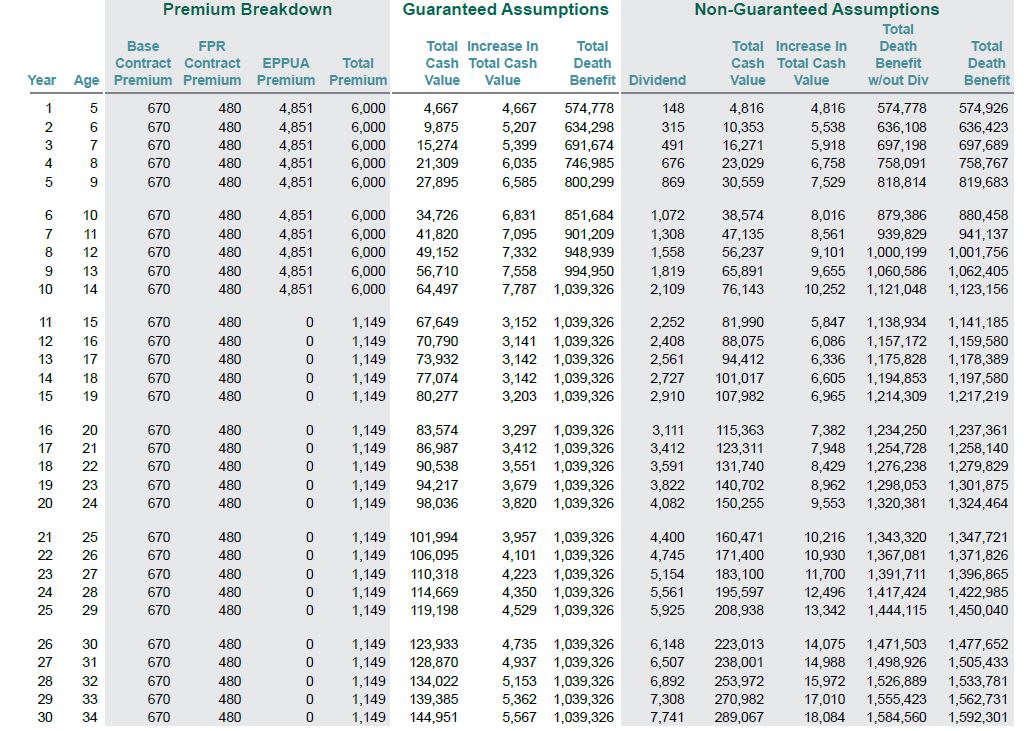

By planning ahead your child can count on this whole life insurance coverage and cash value in the future. One of the main features in a whole life insurance is cash value growth. Gerber cash value would offer a tiny 17 annual return.

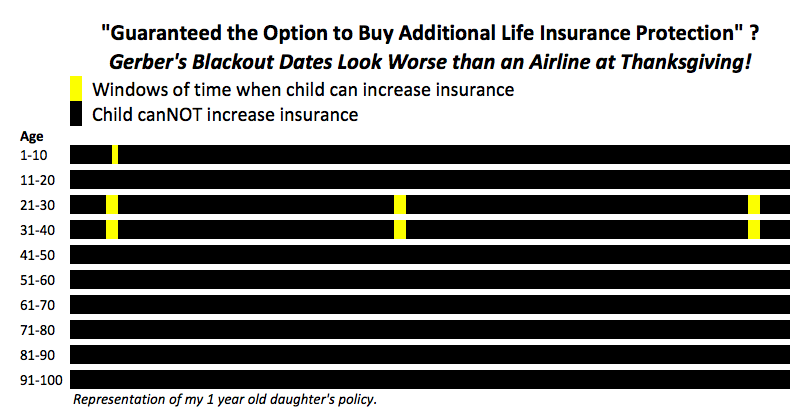

Call us at 1 800 425 7542 today to learn more or to apply now for gerber whole life insurance. If it does the life insurance policy will lose its tax advantages such as tax deferred growth and tax free on death benefit. 5 charts gerber life insurance doesnt want you to see.

Cash value and the guaranteed life plan. Having a lifetime of financial protection. Whole life insurance gives you more financial flexibility.

Thats certainly the goal when deciding to buy whole life insurance. For cash value read our. Top 7 whole life companies for cash value growth.

With whole life insurance you are guaranteed coverage from the day you buy the policy through the rest of your life as long as the premiums are paid which adds up to greater peace of mind. The gerber grow up plan has a maximum death benefit of 100000. You might rightly point out that this is term insurance compared to whole lifebut the truth is almost no one needs permanent life insurance.

One of them is cash value. In addition did you know that whole life insurance policies include features that can protect your financial life in other ways. Policy loan interest rate is 8.

When you think of life insurance what probably comes to mind is financial protection for your family. If this is what you are looking for you should probably not buy a gerber life whole life.

Gerber Life Insurance Online Insurance Concepts

Gerber Life Insurance Online Insurance Concepts

Life Insurance For Children A Look At The 3 Best Policies

Life Insurance For Children A Look At The 3 Best Policies

Gerber Grow Up Plan Cash Value Chart Parta Innovations2019 Org

Gerber Grow Up Plan Cash Value Chart Parta Innovations2019 Org

7 Warnings About Guaranteed Issue Life Insurance Infographic

7 Warnings About Guaranteed Issue Life Insurance Infographic

New Gerber Senior Life Insurance Product Released

New Gerber Senior Life Insurance Product Released

New Gerber Whole Life Insurance Quotes Squidhomebiz

New Gerber Whole Life Insurance Quotes Squidhomebiz

Life Insurance For Children The Best Policy For Your Kids

Life Insurance For Children The Best Policy For Your Kids

Just Say No To Life Insurance Being Pitched As College Savings

Just Say No To Life Insurance Being Pitched As College Savings

Gerber Life Insurance Review 2016

Gerber Life Insurance Review 2016

Gerber S Life Insurance For Kids Is A Rip Off Yuck

Gerber S Life Insurance For Kids Is A Rip Off Yuck

Gerber Grow Up Plan Cash Value Chart Parta Innovations2019 Org

Gerber Grow Up Plan Cash Value Chart Parta Innovations2019 Org

Best Life Insurance For Seniors For 2020 The Simple Dollar

Best Life Insurance For Seniors For 2020 The Simple Dollar

10 Best Cash Value Whole Life Insurance Companies In 2020 Who S 1

10 Best Cash Value Whole Life Insurance Companies In 2020 Who S 1

With The Gerber Life Grow Up Plan You Get Whole Life Insurance

With The Gerber Life Grow Up Plan You Get Whole Life Insurance

Gerber Life Insurance On Twitter How Can You Build A Nest Egg

Gerber Life Insurance On Twitter How Can You Build A Nest Egg

Top 20 Best Whole Life Insurance Companies In 2020

Top 20 Best Whole Life Insurance Companies In 2020

Gerber Life Insurance Grow Up Plan Tv Commercial Builds Cash

Gerber Life Insurance Grow Up Plan Tv Commercial Builds Cash

Gerber Life Insurance What Is Cash Value Milled

Gerber Life Insurance What Is Cash Value Milled

Gerber Life Insurance Company Info On The Best Products They Offer

Gerber Life Insurance Company Info On The Best Products They Offer

With Whole Life Insurance Your Policy Builds Cash Value With

With Whole Life Insurance Your Policy Builds Cash Value With

Whole Life Insurance The End Zone

Whole Life Insurance The End Zone

Gerber Life Insurance Should You Consider This For Your Child

Gerber Life Insurance Should You Consider This For Your Child

Comments

Post a Comment