If youve decided to opt for level term life insurance over decreasing life insurance youll then need to decide whether you want to take out single life insurance or joint life insurance with your partner. Guaranteed level term life insurance is an affordable way to get significant coverage for a set period ranging from 10 15 20 or 30 year terms.

Term Life Vs Whole Life Insurance Daveramsey Com

Term Life Vs Whole Life Insurance Daveramsey Com

As a result the.

Guaranteed level term life insurance. Level term life insurance like all term policies lasts for a set period of time before it expires. Often we think of life insurance as a long term solution but situations can arise when protection is needed for a shorter period of time. For example a term life policy may have guaranteed level premiums for 5 10 15 20 25 30 35 years without increasing regardless of your change in health or employment.

Term insurance has a guaranteed level tax free death benefit and a guaranteed level premium cost for a guaranteed level period of time the term. In this form the premium paid each year remains the same for the duration of the contract. What is guaranteed level term life insurance.

The term guaranteed level term life insurance has to due with the premiums paid by the insured. For example if you purchase a 20 year term life plan for 50 per month the insurance company by contract is guaranteeing not to change your premiums for 20 years as long as you pay your premiums every month. Traditionally the terms offered were 10 15 20 and 30 years.

Brighthouse one year term is a life insurance product that delivers guaranteed affordable protection. Level term life insurance. Guaranteed level term life insurance refers to the premium cost assigned to the policy for a specific period of time.

I typically endorse universal guaranteed life insurance rather than whole life insurance. The premium rate for the policy stays the same or level for the entire life of the policy. A single level term life insurance policy helps to cover the financial contributions you make in your partnership or family.

The most common terms are 10 15 20 and 30 years. The death benefit also stays the same. More common than annual renewable term insurance is guaranteed level premium term life insurance where the premium is guaranteed to be the same for a given period of years.

Guaranteed term life insurance differs from whole life in that its used to cover specific periods of time whereas whole life insurance is designed to build cash value and cover you for your entire life. The word level is whats key in the definition. Guaranteed level insurance vs.

Level premium insurance is term life insurance for which the premiums are guaranteed to remain the same throughout the contract while the amount of coverage provided increases.

Types Of Life Insurance Policies Wide Info

Types Of Life Insurance Policies Wide Info

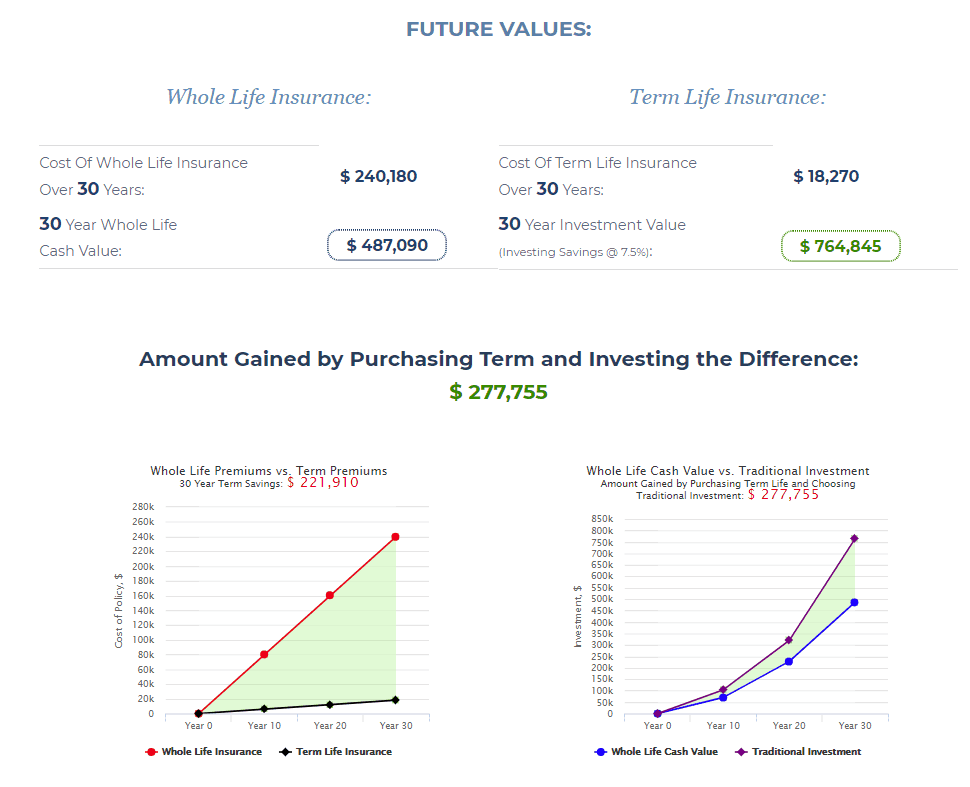

Why Whole Life Insurance Is A Bad Investment Mom And Dad Money

Why Whole Life Insurance Is A Bad Investment Mom And Dad Money

Term Life Insurance Level Benefit Term Life Insurance

Term Life Insurance Level Benefit Term Life Insurance

Making The Most Of Supplemental Group Life Insurance

Making The Most Of Supplemental Group Life Insurance

Cheap Life Insurance Family Protection Security Mse

Cheap Life Insurance Family Protection Security Mse

Level Term Life Insurance Explained Life Ant

Level Term Life Insurance Explained Life Ant

5 Reasons Why Term Life Insurance Is Best Insurance Blog By Chris

5 Reasons Why Term Life Insurance Is Best Insurance Blog By Chris

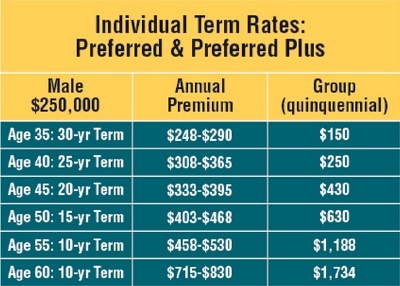

John Hancock Producer Guide Term Life Pdf Shaw American

John Hancock Producer Guide Term Life Pdf Shaw American

2019 Primerica Life Insurance Review The Ultimate Dopamine Rush

2019 Primerica Life Insurance Review The Ultimate Dopamine Rush

Different Types Of Life Insurance Explanation The Ultimate Guide

Different Types Of Life Insurance Explanation The Ultimate Guide

Guaranteed Issue Life Insurance Aig Direct

What Is Term Life Insurance Daveramsey Com

What Is Term Life Insurance Daveramsey Com

![]() Term Life Insurance Instant Quotes Accuquote

Term Life Insurance Instant Quotes Accuquote

Term Life Vs Universal Life Insurance

Term Life Vs Universal Life Insurance

The Best Life Insurance Companies In 2020 Policygenius

The Best Life Insurance Companies In 2020 Policygenius

Term Life Insurance Definition

Term Life Insurance Definition

Guaranteed Issue Life Insurance Aig Direct

Life Insurance Faqs Long Beach Ca

Life Insurance Faqs Long Beach Ca

Term To Age 100 Life Insurance

Term To Age 100 Life Insurance

Best Life Insurance For Seniors For 2020 The Simple Dollar

Best Life Insurance For Seniors For 2020 The Simple Dollar

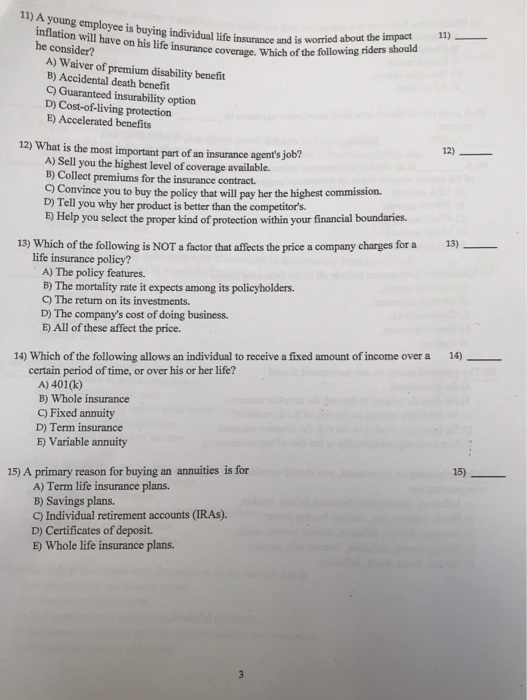

Solved 11 Vidual Life Insurance And Is Worried About The

Solved 11 Vidual Life Insurance And Is Worried About The

Comments

Post a Comment