If you need access to fund immediately a life insurance policy loan could be in your best interest. You can just call the life insurance company find out how much you can borrow from your policy and then have them send you a check or pay you via direct deposit.

You Probably Didn T Know These Five Facts About Student Loans

You Probably Didn T Know These Five Facts About Student Loans

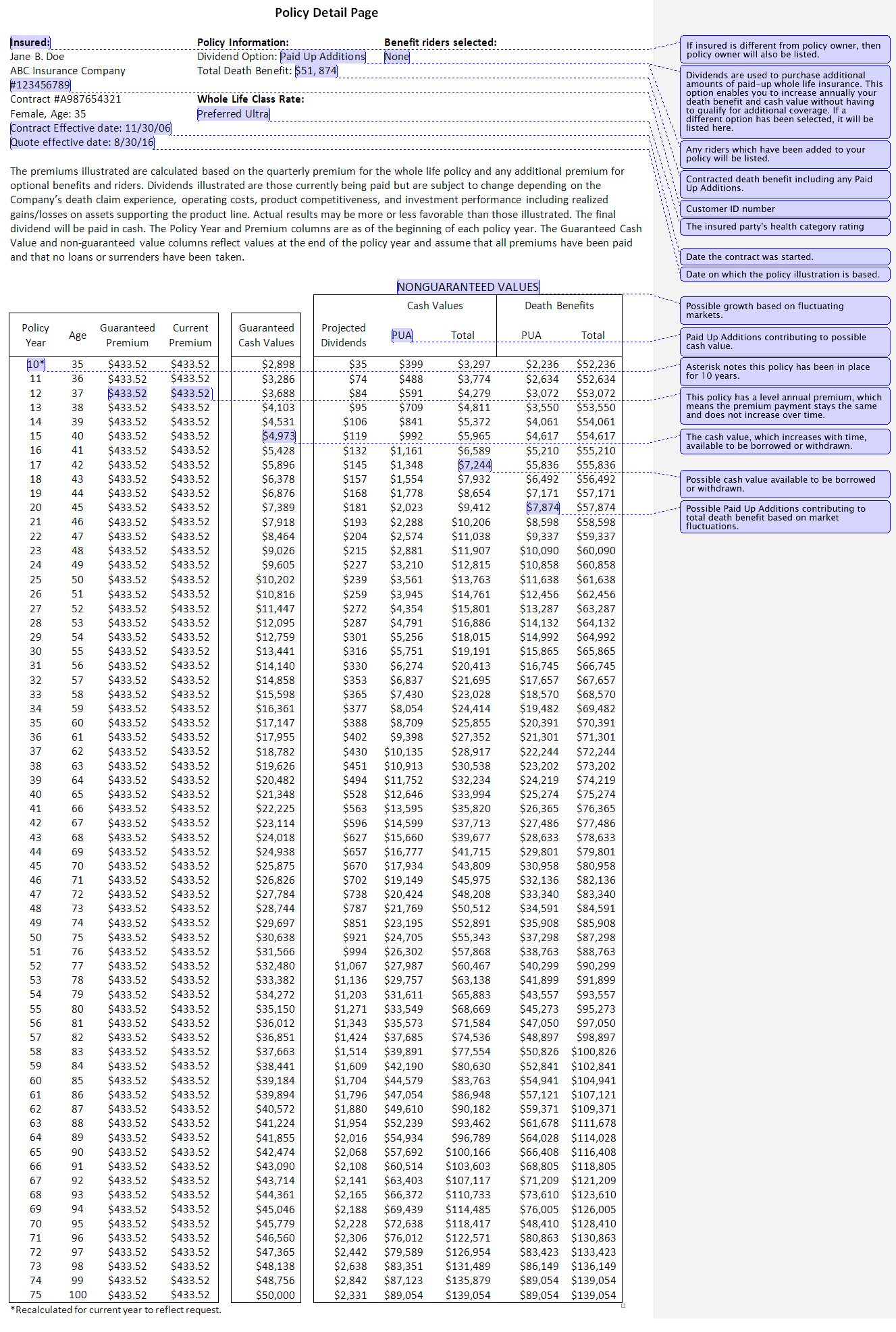

If you have a permanent life insurance policy that is accumulating a cash value through premiums then you can borrow the money eventually.

How to borrow money from your life insurance policy. Borrowing from your life insurance policy can be a quick and easy way to get cash in hand when you need it. But if you dont have the. For example when you borrow from a bank you have monthly payments to make over a fixed term whereas if you borrow from your life insurance policy you can pay back as little or as much as you want at any time interval.

Unlike term insurance which pays death benefits only if you die within a specified term permanent life insurance including whole universal variable and. The cash value of a permanent life insurance policy can be a quick source of funds during a financial emergency. This is only after your cash value has reached a particular size usually after a few years of paying premiums.

Whether it be for an emergency some needed home repairs or that cant miss investment opportunity just about everyone needs a quick infusion of cash now and then. Whether you need money to pay a medical bill or for your kids tuition life insurance policy loans offer quick cash with no questions asked but borrower beware. In addition you dont have to pay the annual interest so long as the total outstanding loan original loan plus accumulated interest doesnt exceed the policys cash value.

Jane did not actually borrow from her policy. She borrowed from her insurer using the insurance policys cash value as collateral. With 120000 in cash value jane was able to obtain a 100000 loan less than the 108000 90 of cash value which is the maximum you are allowed to borrow limit on loans in her case.

Borrowing from your life insurance policy allows a lot more flexibility in repayment. How to borrow from your life insurance policy. This article will cover the basic information you need to decide if borrowing from your life insurance is the right move.

The loan function of a whole life insurance policy is one of the more attractive options that life insurance presentsthe ability to borrow money from your life insurance policy gives you flexibility that other people do not have. You can pay back a life insurance policy loan at any time. How to borrow from your life insurance policy.

When you borrow from your life insurance policy you dont actually have to pay back the loan. You can only borrow against a permanent or whole life insurance policy.

Life Insurance Policy Surrender Want To Surrender Your Life

Life Insurance Policy Surrender Want To Surrender Your Life

Using The Cash Value Of Your Life Insurance Policy The Simple Dollar

Using The Cash Value Of Your Life Insurance Policy The Simple Dollar

Life Insurance Policy Loans Tax Rules And Risks

Life Insurance Policy Loans Tax Rules And Risks

How To Read Your Life Insurance Policy

How To Read Your Life Insurance Policy

Life Insurance Your Most Important Policy Friday Harbor Wa

Life Insurance Your Most Important Policy Friday Harbor Wa

Https Encrypted Tbn0 Gstatic Com Images Q Tbn 3aand9gcqm58qpcwkrbsooowcimcdjruv11wvmwrvphnqxpphizh5l60lc

Https Encrypted Tbn0 Gstatic Com Images Q Tbn 3aand9gcqm58qpcwkrbsooowcimcdjruv11wvmwrvphnqxpphizh5l60lc

Is Life Insurance A Smart Investment

Is Life Insurance A Smart Investment

Loan Against Life Insurance Should You Opt For A Loan Against

Loan Against Life Insurance Should You Opt For A Loan Against

12 Questions To Ask Before Purchasing Whole Life Insurance The

12 Questions To Ask Before Purchasing Whole Life Insurance The

Life Insurance Advice That Can Save You Money By Belencontreras41

Life Insurance Advice That Can Save You Money By Belencontreras41

How To Borrow Money From Your Life Insurance Moneyspace Get

How To Borrow Money From Your Life Insurance Moneyspace Get

Should You Borrow Against Your Life Insurance Policy Quotacy

Should You Borrow Against Your Life Insurance Policy Quotacy

When To Borrow Against Your Life Insurance Policy Nerdwallet

When To Borrow Against Your Life Insurance Policy Nerdwallet

How To Grow Generational Wealth In Your Family

How To Grow Generational Wealth In Your Family

Can I Sell My Life Insurance Policy For Cash Senior Resources

Can I Sell My Life Insurance Policy For Cash Senior Resources

Life Insurance Policy Loans Tax Rules And Risks

Life Insurance Policy Loans Tax Rules And Risks

Life Insurance Online Life Insurance Plans Polices In India

Life Insurance Online Life Insurance Plans Polices In India

When To Cash In A Life Insurance Policy The Dough Roller

When To Cash In A Life Insurance Policy The Dough Roller

Borrow Against Your Life Insurance Policy Yes Or No

Borrow Against Your Life Insurance Policy Yes Or No

/Borrowing-money-from-a-life-insurance-policy-57afcb4d5f9b58b5c248b3c6.jpg) Borrowing From A Life Insurance Policy

Borrowing From A Life Insurance Policy

How Cash Value Builds In A Life Insurance Policy

How Cash Value Builds In A Life Insurance Policy

How Do Life Insurance Policy Loans Work The Insurance Pro Blog

How Do Life Insurance Policy Loans Work The Insurance Pro Blog

Comments

Post a Comment