Term the period your life insurance policy lasts as long as youve been paying the premiums if you buy a term life insurance policy. How to buy whole life insurance.

Whole Life Insurance Is A Bad Investment

Whole Life Insurance Is A Bad Investment

Some whole life policies can be paid up after a certain number of years.

How to buy whole life insurance. With whole life insurance your premium payments remain the same over the life of the policy. Posted by kevin mercadante last updated on april 11 2019 whole advertiser disclosure. Thats where the internet comes in handy which well get to in a moment.

Whole life insurance covers you for a lifetime with steady premiums and a guaranteed return on the policys cash value. Other types of life insurance such as permanent and other cash value life insurance last your whole life instead of just a term. Term life insurance is the only kind you should consider.

Thats different than term life which is only for a period such as 20 or 30 years. Know where to buy whole life insurance and how to find the best policy. How do you buy whole life insurance online.

This article may contain links from our advertisers. Whole life insurance is one of the four main types of permanent life insurance. In the past buying coverage meant one thing.

While completing all of the required forms can be a long and daunting process it can be made easier if you are prepared and have all the necessary materials available. It provides coverage as long as you pay the premiums or until you pass away. Once you know what kind of life insurance you want to buy comparing policies gets a bit easier but there are still a number of variables.

Whole life is the most common type of permanent life insurance. What kind of life insurance to buy. By theg buy term insurance now and protect your insurability.

Opinions reviews analyses recommendations are the authors alone. Reasons to buy whole life insurance. You can choose how often youd like to make premium payments too annually semiannually quarterly or monthly.

Universal life insurance is the most basic type of whole life insurance in which some of the premium paid by the purchaser goes toward a death benefit to be used in the event that the purchaser. When filling out an application to buy whole life insurance you want to be sure to provide all of the correct information and documentation. Lets buy whole life insurance online.

Calling an agent or broker on the phone working with this person one on one and eventually making your way through the process. A parent or relative can buy life insurance for a minor purchasing a whole life insurance. The sooner you purchase life insurance the better as it becomes more expensive with each passing year.

Whole Life Insurance For Over 50 Year Old Tips And Trick Healthgds

Whole Life Insurance For Over 50 Year Old Tips And Trick Healthgds

Term Life Insurance Vs Whole Life Insurance And When To Use These

Term Life Insurance Vs Whole Life Insurance And When To Use These

Term Life Insurance Vs Whole Life Insurance Johnson

Term Life Insurance Vs Whole Life Insurance Johnson

Whole Life Policies For Dummies Are They A Good Way To Insure

Whole Life Policies For Dummies Are They A Good Way To Insure

Your Financial Bunker Life Insurance

Your Financial Bunker Life Insurance

Difference Between Term Insurance Plan And Whole Life Insurance

Difference Between Term Insurance Plan And Whole Life Insurance

Term Life Vs Whole Life Insurance Which Is Right For You

Term Life Vs Whole Life Insurance Which Is Right For You

Leave A Tax Free Legacy For Your Children With Whole Life

Leave A Tax Free Legacy For Your Children With Whole Life

What Is Whole Life Insurance 2020 Guide Whole Life Insurance

What Is Whole Life Insurance 2020 Guide Whole Life Insurance

You Picked Whole Life Insurance Now What Nerdwallet

You Picked Whole Life Insurance Now What Nerdwallet

7 Warnings About Guaranteed Issue Life Insurance Infographic

7 Warnings About Guaranteed Issue Life Insurance Infographic

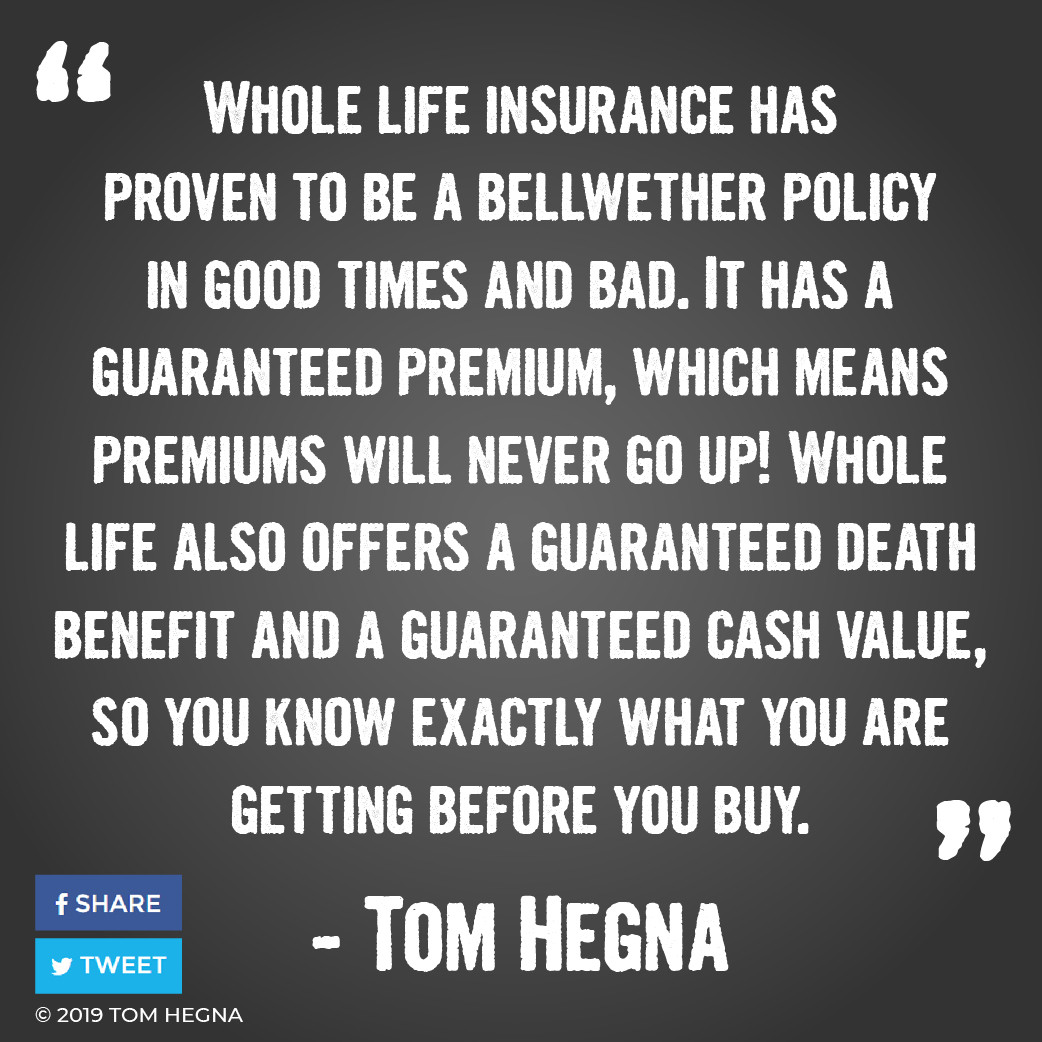

Whole Life Insurance Plans In India

Whole Life Insurance Plans In India

The Most Important Question To Ask When Buying Whole Life Insurance

The Most Important Question To Ask When Buying Whole Life Insurance

Amazon Com Live Your Life Insurance Surprising Strategies To

Amazon Com Live Your Life Insurance Surprising Strategies To

![]() Whole Life Insurance Guaranteed Death Benefit And Premiums

Whole Life Insurance Guaranteed Death Benefit And Premiums

5 Reasons Why Term Life Insurance Is Best Insurance Blog By Chris

5 Reasons Why Term Life Insurance Is Best Insurance Blog By Chris

Term Insurance Vs Whole Life Insurance What Is Insurance How

Term Insurance Vs Whole Life Insurance What Is Insurance How

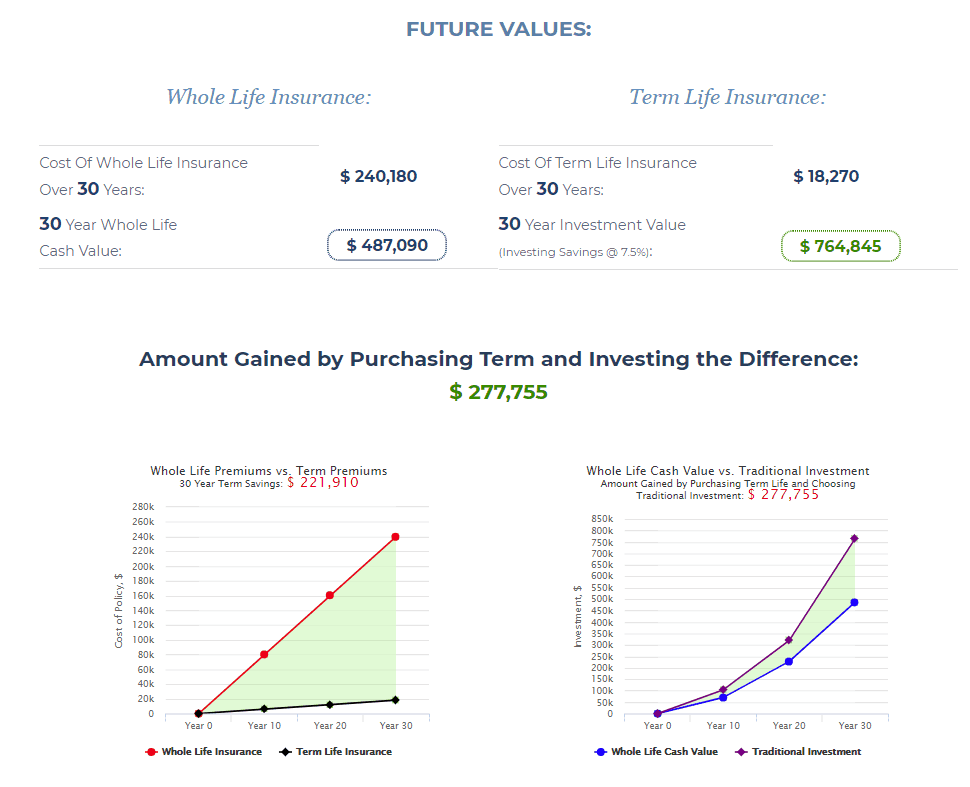

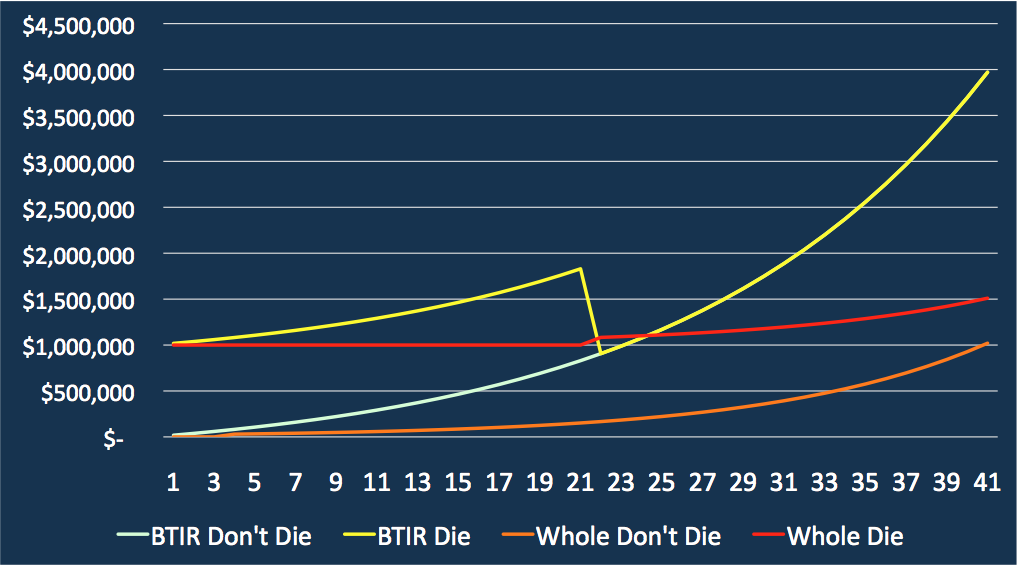

Whole Life Vs Term Life Insurance The Buy Term Invest The

Whole Life Vs Term Life Insurance The Buy Term Invest The

Is Life Insurance For Children A Waste Of Money

Is Life Insurance For Children A Waste Of Money

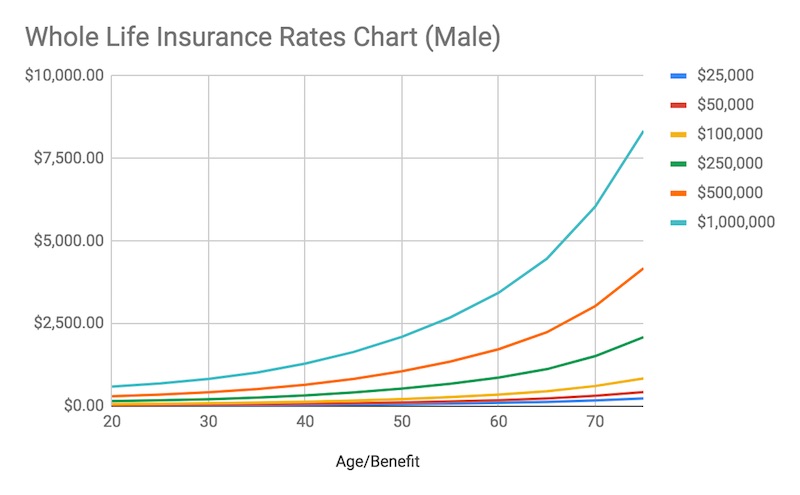

How Much Does Whole Life Insurance Cost Charts 2020 Rates

How Much Does Whole Life Insurance Cost Charts 2020 Rates

Seven Tips For Buying Whole Life Insurance Wealth Nation

Seven Tips For Buying Whole Life Insurance Wealth Nation

When To Buy Whole Life Insurance Singapore Blog Pang Zhe Liang

When To Buy Whole Life Insurance Singapore Blog Pang Zhe Liang

Life Insurance In Singapore The Basics Of Whole Life And Term

Comments

Post a Comment