Life insurance provides a death benefit payout to your loved ones in the event that you die. You can do this by notifying your life insurance carrier that you would like to take money out of your policy.

High Cash Value Life Insurance Policy Becoming Your Own Bank

High Cash Value Life Insurance Policy Becoming Your Own Bank

Getting cash out of your life insurance by tapping into its cash value is the easiest way to cash in the life insurance policy.

How to cash out life insurance. Before you decide to sell your life insurance policy for cash if you need to get cash out of your life insurance policy seek the advice of a life settlement broker financial expert and a tax professional. They can help you understand how doing so may affect your financial future. Some people think that once the kids have completed college or you have paid off your mortgage it is time to cancel or reduce life insurance.

If you own one of these policies usually called permanent whole or universal life insurance you can cash it out in a relatively simple process. Here are some factors to consider before. Baby boomers are living longer and cashing out life.

The choice can have a number of financial implications including tax liability. However if you need cash or no longer require coverage there are ways you can cash out of your policy. So if you ever think can i cash in my term life insurance policy the answer is no.

Generally speaking term life insurance has no cash value. If youve built up a sizable cash value you may also choose to take out a loan against your policylife insurance companies often offer these cash value loans at interest rates lower than a. Heres everything you need to know about cashing out a life insurance policy.

If you are out of options and must access your life insurance policy its better to withdraw or borrow cash versus surrendering the policy altogether. Walt disney ray kroc and james cash penney all famously cashed out life insurance policies to start their companies or to keep them afloat during tough times. Whether to cash in a life insurance policy is an important decision.

However it doesnt work for term life insurance policies since they dont have any cash value. The most direct way to access the cash value in your policy is to make a withdrawal from it. Some term policies have whats called a return of premium rider that if held for the contract period can return the premium outlay to the policy owner.

Use Cash Value Life Insurance To Create Retirement Income

Use Cash Value Life Insurance To Create Retirement Income

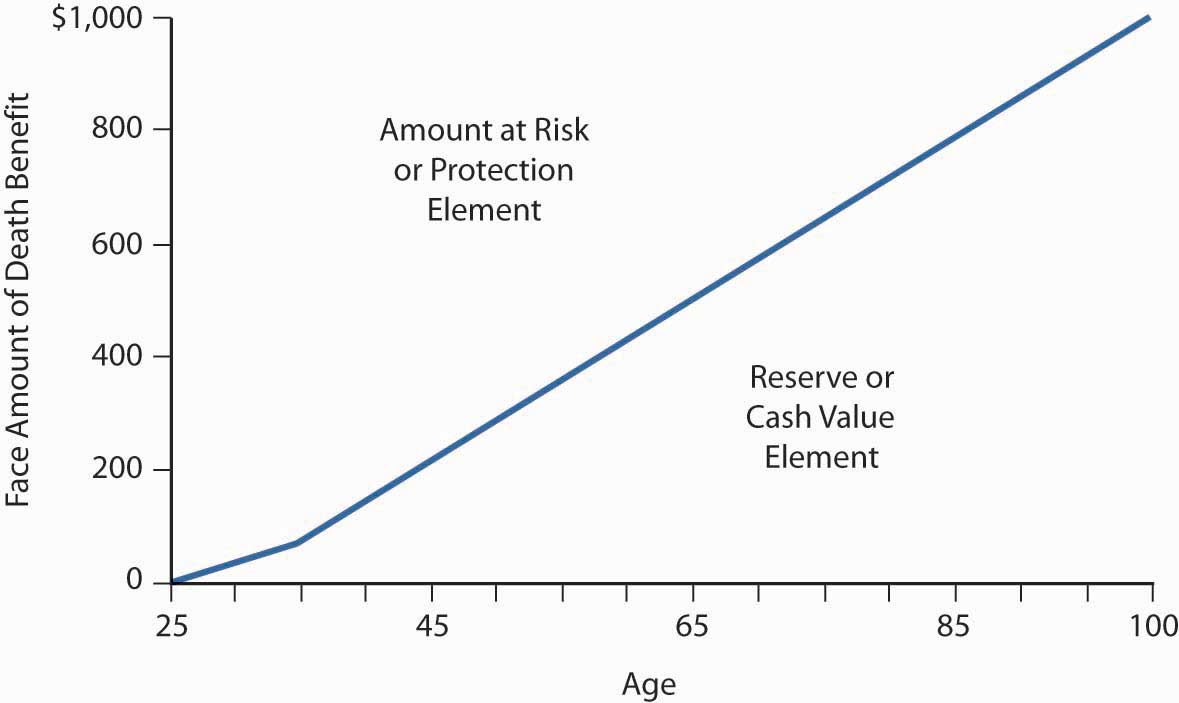

How Cash Value Life Insurance Works

How Cash Value Life Insurance Works

Can I Withdraw Cash Value From Any Life Insurance Policy Globe

Can I Withdraw Cash Value From Any Life Insurance Policy Globe

Term Life Vs Whole Life Insurance Differences Explained

Term Life Vs Whole Life Insurance Differences Explained

Sell Life Insurance Policy For Cash 2020 Guide Magna Life

Sell Life Insurance Policy For Cash 2020 Guide Magna Life

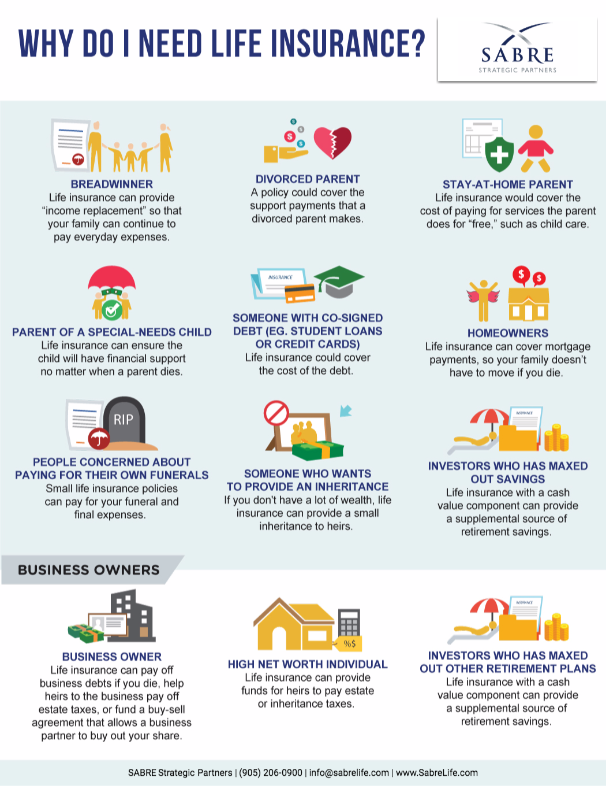

Do You Really Need Life Insurance Sabre Strategic Partners

Do You Really Need Life Insurance Sabre Strategic Partners

Cashing Out Life Insurance Policy 4 Ways To Cash In Mason Finance

Cashing Out Life Insurance Policy 4 Ways To Cash In Mason Finance

Life Insurance Policy Loans Tax Rules And Risks

Life Insurance Policy Loans Tax Rules And Risks

How Life Insurance Can Help You Plan For Retirement

How Life Insurance Can Help You Plan For Retirement

Individual Life Insurance And Investment Pioneer Your Insurance

Individual Life Insurance And Investment Pioneer Your Insurance

Can I Cash Out Employer Based Life Insurance Chron Com

Can I Cash Out Employer Based Life Insurance Chron Com

Prudential Surrender Form Fill Out And Sign Printable Pdf

Prudential Surrender Form Fill Out And Sign Printable Pdf

Whole Life Insurance Cash Value Chart

Cash Value Life Insurance Explained Thrivent Financial

Cash Value Life Insurance Explained Thrivent Financial

![]() Gofundme Is Not Life Insurance Get Insured Young Income

Gofundme Is Not Life Insurance Get Insured Young Income

Can I Cash Out My Term Life Insurance Policy Quotacy Q A

Can I Cash Out My Term Life Insurance Policy Quotacy Q A

Cashing Out Life Insurance What Are The Advantages And

Cashing Out Life Insurance What Are The Advantages And

4 Things You Can Do With Your Cash Value Life Insurance In 2019

4 Things You Can Do With Your Cash Value Life Insurance In 2019

Cash Value Life Insurance Policy Loans Not Such A Good Deal

Cash Value Life Insurance Policy Loans Not Such A Good Deal

Life Settlements Guide Selling A Life Insurance Policy

Life Settlements Guide Selling A Life Insurance Policy

A Quick Guide To The Gerber Life Insurance Policies Gerber Life

A Quick Guide To The Gerber Life Insurance Policies Gerber Life

5 Steps Before Cashing Out Your Life Insurance Policy Get More Money

5 Steps Before Cashing Out Your Life Insurance Policy Get More Money

Comments

Post a Comment