Some permanent life insurance policies offer cash value on top of a death benefit. Life insurance policies may provide a cash surrender value.

Life Insurance Policy Cost Basis Finance Zacks

Life Insurance Policy Cost Basis Finance Zacks

Keep in mind that if you choose to go this route to withdraw cash value from your life insurance policy you may be responsible for the payment of any taxes based on the part of the withdrawal that is greater than premium payments made during the life of the policy.

How to take money out of life insurance policy. Heres everything you need to know about cashing out a life insurance policy. When you borrow based on the cash value of your life insurance policy you are borrowing money from the life insurance company. The options for canceling a life insurance policy depend on your age how long youve had the coverage and the type of life insurance term or permanent.

Borrowing from your life insurance policy can be a quick and easy way to get cash in hand when you need it. How often can i take money out of my life insurance. This value is a cash reserve that allows you to spend part of the policy during your lifetime.

You can do this by notifying your life insurance carrier that you would like to take money out of your policy. The decision to take out a life insurance policy is more about the stage in life you have reached than simply your age and for some people it is an unnecessary cost. How borrowing from a life insurance policy works one of the greatest differences between policy loans and traditional loans is that you dont have to pay back the loan to your own insurance policy.

Life insurance provides a death benefit payout to your loved ones in the event that you die. We lay out the possible choices and. However when you take money out of a life insurance policy you might owe taxes.

Obtain money via direct withdrawal from your life insurance policy. If your policy has cash value its your money and you can take it out whenever you want. You can only borrow against a permanent or whole life insurance policy.

The most direct way to access the cash value in your policy is to make a withdrawal from it. However if you need cash or no longer require coverage there are ways you can cash out of your policy. If youve built up a sizable cash value you may also choose to take out a loan against your policylife insurance companies often offer these cash value loans at interest rates lower than a.

The frequency of withdrawals from your policy depends on how much money has accumulated in the policy and how. Whether youll owe money depends on your total investment gains.

Whole Life Term Insurance Vs Regular Term Life Insurance Which Is

Whole Life Term Insurance Vs Regular Term Life Insurance Which Is

3 Ways To Find Out If Someone Has A Life Insurance Policy

3 Ways To Find Out If Someone Has A Life Insurance Policy

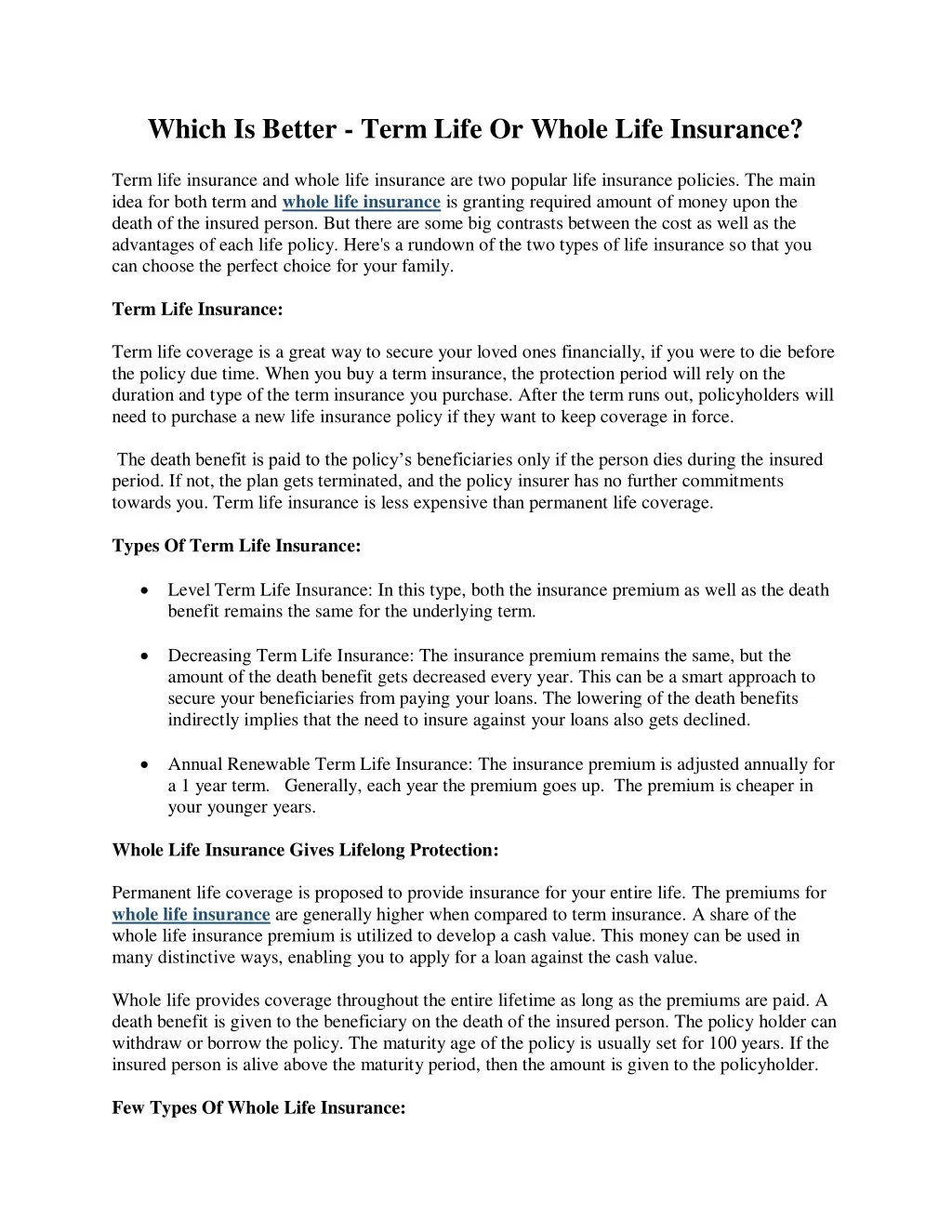

Ppt Which Is Better Term Life Or Whole Life Insurance

Ppt Which Is Better Term Life Or Whole Life Insurance

When Should You Review Your Life Insurance Cover Find Out The

When Should You Review Your Life Insurance Cover Find Out The

How Do I Change My Life Insurance Policy Confused Com

How Do I Change My Life Insurance Policy Confused Com

How To Speed Up A Life Insurance Payout

How To Speed Up A Life Insurance Payout

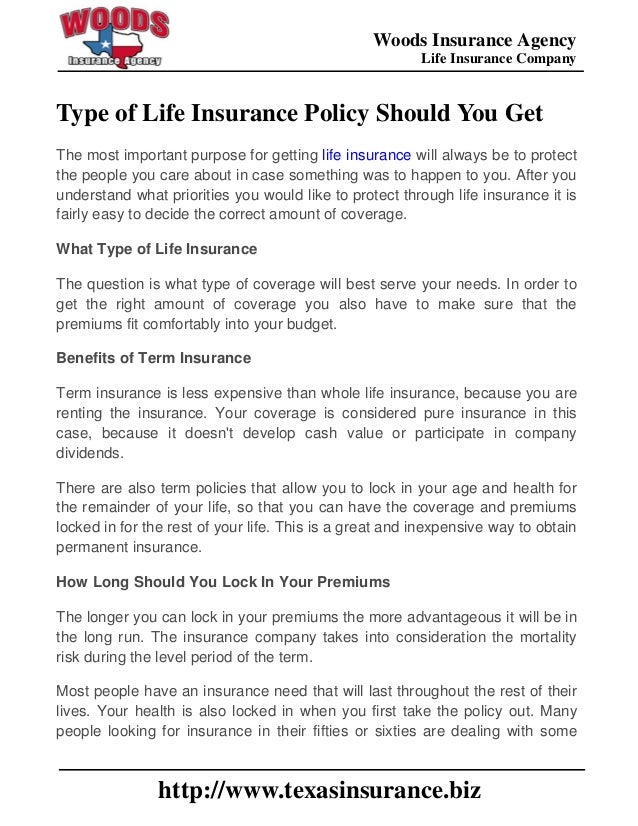

Type Of Life Insurance Policy Should You Get

Type Of Life Insurance Policy Should You Get

Life Insurance Buy Life Insurance Plans Policies Online In

Life Insurance Buy Life Insurance Plans Policies Online In

Is Cash Value Life Insurance A Good Idea Or A Bad Idea Life Ant

Is Cash Value Life Insurance A Good Idea Or A Bad Idea Life Ant

Avoid Surrendering Life Insurance Policy 1

Avoid Surrendering Life Insurance Policy 1

Term Life Vs Whole Life Insurance Daveramsey Com

Term Life Vs Whole Life Insurance Daveramsey Com

Pros And Cons Of Group Life Insurance Through Work

Pros And Cons Of Group Life Insurance Through Work

Cashing Out Life Insurance Policy 4 Ways To Cash In Mason Finance

Cashing Out Life Insurance Policy 4 Ways To Cash In Mason Finance

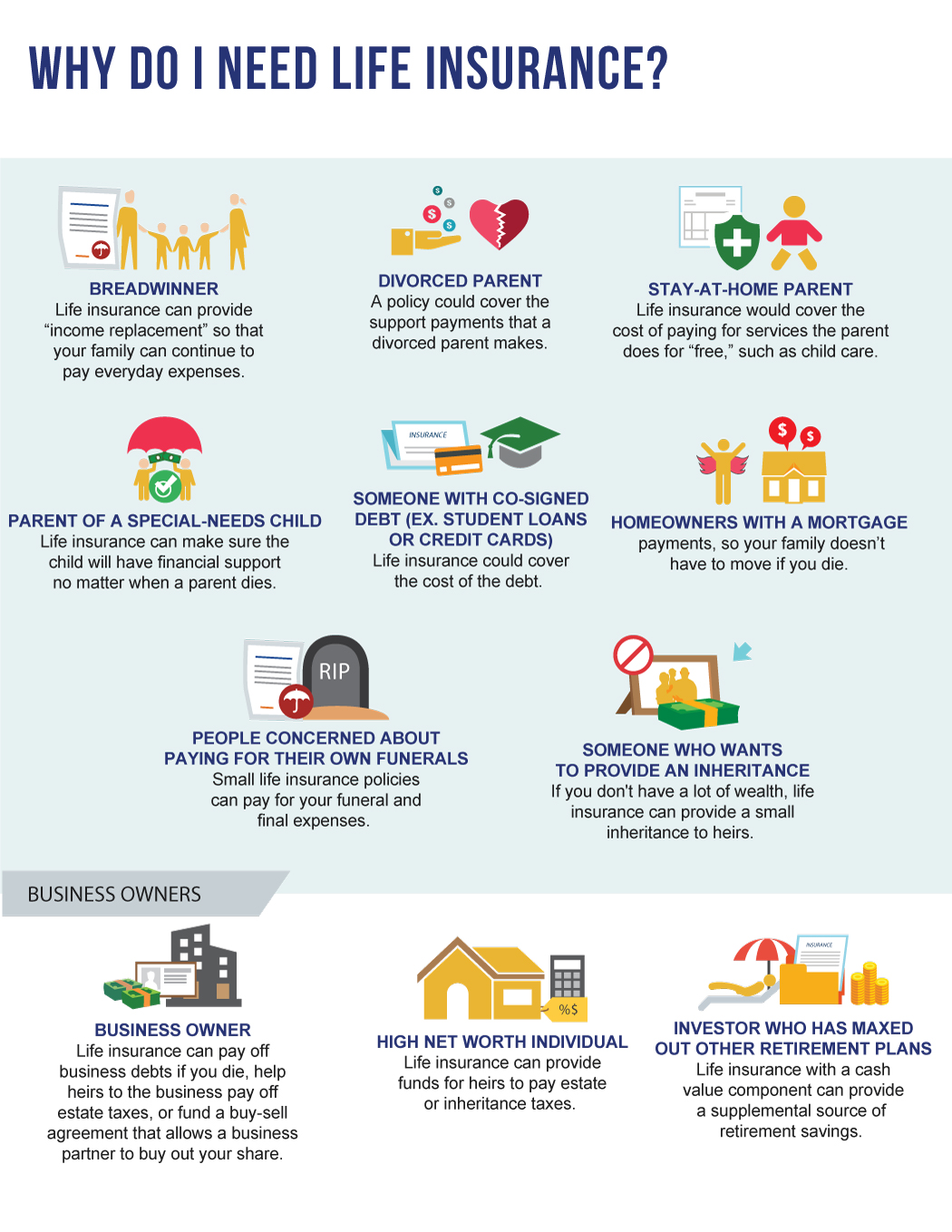

Do You Really Need Life Insurance Legacy Wealth Advisors

Do You Really Need Life Insurance Legacy Wealth Advisors

Universal Life Insurance Definition

Universal Life Insurance Definition

How Does A Life Insurance Policy Payout Work Haven Life

How Does A Life Insurance Policy Payout Work Haven Life

How Much Does Life Insurance Cost Anyway Trusted Choice

How Much Does Life Insurance Cost Anyway Trusted Choice

Can I Sell My Life Insurance Policy All For Cash Mason Finance

Can I Sell My Life Insurance Policy All For Cash Mason Finance

What Percentage Do You Get When You Cash Out A Whole Life

What Percentage Do You Get When You Cash Out A Whole Life

Paid Up Life Insurance Explained The Insurance Pro Blog

Paid Up Life Insurance Explained The Insurance Pro Blog

Which Type Of Life Insurance Fits You

Which Type Of Life Insurance Fits You

Can I Withdraw Cash Value From Any Life Insurance Policy Globe

Can I Withdraw Cash Value From Any Life Insurance Policy Globe

Life Insurance Policy 2020 Plan You Shouldn T Miss Wishpolicy

Life Insurance Policy 2020 Plan You Shouldn T Miss Wishpolicy

Comments

Post a Comment