Long term care funding can be extremely challenging but assets you already own like permanent life insurance could serve as a great funding mechanism. The hybrid policies are permanent life insurance policies with a long term care rider.

New Hybrid Long Term Care Insurance Includes Life Insurance

New Hybrid Long Term Care Insurance Includes Life Insurance

The concept behind hybrid long term care plans is fairly simple.

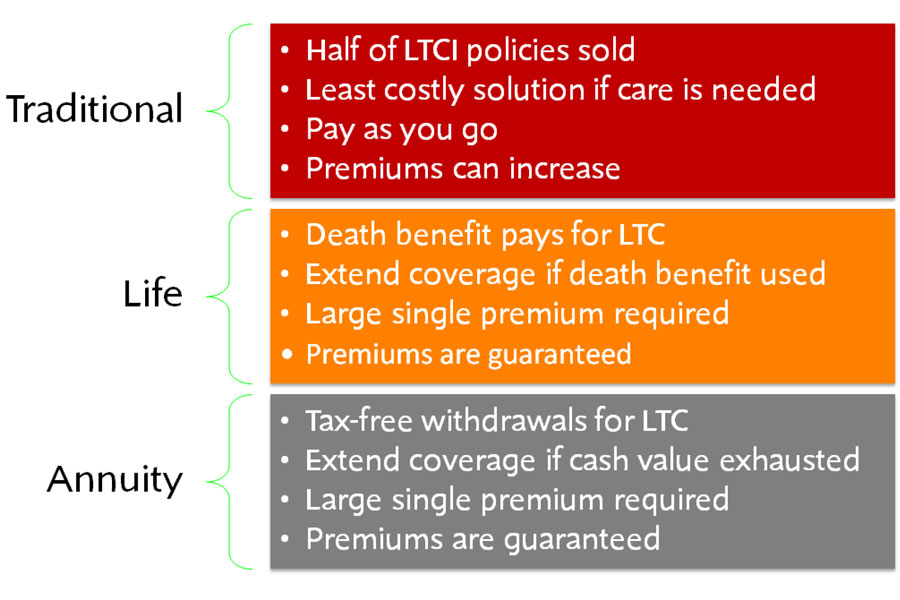

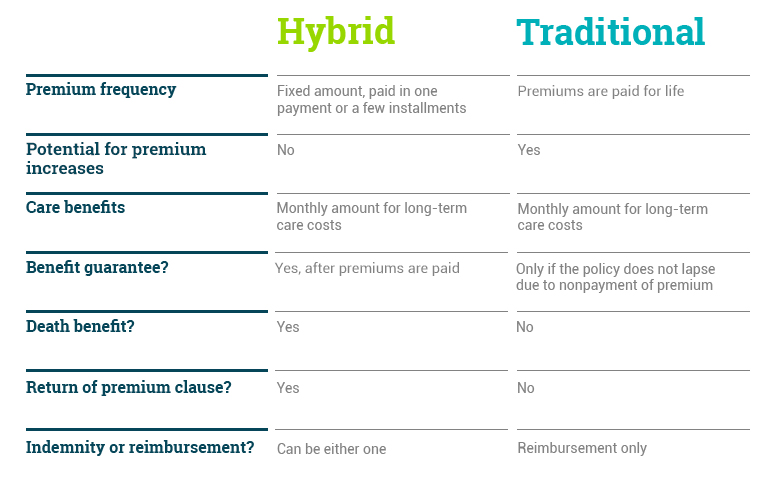

Hybrid life insurance and long term care insurance. If youre investigating long term care insurance youll want to also compare a hybrid ltc policy where you purchase a policy and have it completely paid off in a 1 5 or 10 year payments. Hybrid long term care insurance policies with life benefits. Simply put a hybrid long term care policy combines the benefits of life insurance or annuity with long term care benefits.

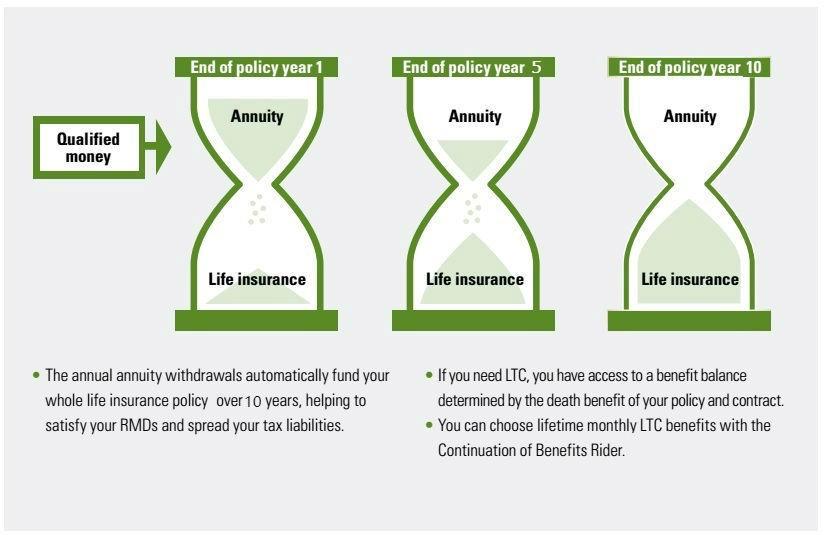

Others will pair an annuity with long term care insurance to make a single policy long term care annuity. Attempts to combat concerns about traditional long term care insurance have resulted in combination or hybrid products using an asset based approach to fund long term care. Life insurance and long term care funding.

These new approaches. They often appeal to cost conscious consumers who need both types of coverage and want to avoid paying separately for both a long term care policy and a life insurance policy. Hybrid life insurance policies offering leveraged long term care payouts are in demand as they provide both living and death benefits to the ownerinsured.

A person can buy a hybrid policy by paying a one time lump sum premium. Typically these policies are used more for long term care benefits but they do provide tax free payouts at death. Most of these products combine life insurance with long term care insurance into a single hybrid policy.

Hybrid combined or linked long term care policies typically feature a life insurance component with a long term care rider. There are also annuity based policies where an existing insurance policy from a different carrier can be linked to a long term care rider. Ltc payouts reduce your life insurance policys cash value andor death benefit which may result in leaving little or no death benefit to your heirs if you need long term care for an extended.

Hybrid long term care policies combine long term care insurance with permanent life insurance policies that include a savings investment component.

Top 10 Best Long Term Care Insurance Companies 2020 Update

Top 10 Best Long Term Care Insurance Companies 2020 Update

Considering Hybrid Long Term Care Insurance Long Term Care Blog

Considering Hybrid Long Term Care Insurance Long Term Care Blog

Rules For Tax Deductibility Of Long Term Care Insurance

Rules For Tax Deductibility Of Long Term Care Insurance

Long Term Care Insurance Pros Cons And Why It Matters After

Long Term Care Insurance Pros Cons And Why It Matters After

Rules For Tax Deductibility Of Long Term Care Insurance

Rules For Tax Deductibility Of Long Term Care Insurance

Using An Ira Or 401 K To Pay For Hybrid Combination Life And Long

Using An Ira Or 401 K To Pay For Hybrid Combination Life And Long

The High Cost Of Long Term Care Insurance And What To Use Instead

The High Cost Of Long Term Care Insurance And What To Use Instead

What You Need To Know About Long Term Care Insurance Family

What You Need To Know About Long Term Care Insurance Family

Lincoln Moneyguard Iii Hybrid Combination Life And Long Term Care

Lincoln Moneyguard Iii Hybrid Combination Life And Long Term Care

Blog Long Term Care Insurance America

Blog Long Term Care Insurance America

Hybrid Life Insurance Policies Increasingly Popular As Long Term

Hybrid Life Insurance Policies Increasingly Popular As Long Term

Hybrid Life Insurance Policies Gain Popularity As Ltc Payment Plans

Hybrid Life Insurance Policies Gain Popularity As Ltc Payment Plans

Hybrid Policies Blend Long Term Care And Life Coverage Molyneaux

Hybrid Policies Blend Long Term Care And Life Coverage Molyneaux

A Case Study Of Long Term Care Product Alternatives Pdf Free

A Case Study Of Long Term Care Product Alternatives Pdf Free

Can I Get Long Term Care Insurance With Pre Existing Conditions

Can I Get Long Term Care Insurance With Pre Existing Conditions

Long Term Care Insurance Comparisons For Determining The Best

Long Term Care Insurance Comparisons For Determining The Best

What Is Hybrid Long Term Care Insurance Brighthouse Financial

What Is Hybrid Long Term Care Insurance Brighthouse Financial

Benefits Of Life Insurance With Long Term Care Coverage

Benefits Of Life Insurance With Long Term Care Coverage

Long Term Care You Have Options The Bottoms Group

Long Term Care You Have Options The Bottoms Group

Calameo How Does Hybrid Long Term Care And Life Insurance Work

Calameo How Does Hybrid Long Term Care And Life Insurance Work

Hybrid Life Insurance For Long Term Care Hyers And Associates

Hybrid Life Insurance For Long Term Care Hyers And Associates

Comments

Post a Comment