Imputed life insurance if you are looking for an easy way to get insurance quotes then our service provides you with a convenient way to get the information you need. Imputed life insurance if you are looking for low cost comprehensive insurance then we can provide you with multiple quotes to help you find a provider you are happy with.

Group Term Life Insurance A Compliance Primer Crystal Company

Group Term Life Insurance A Compliance Primer Crystal Company

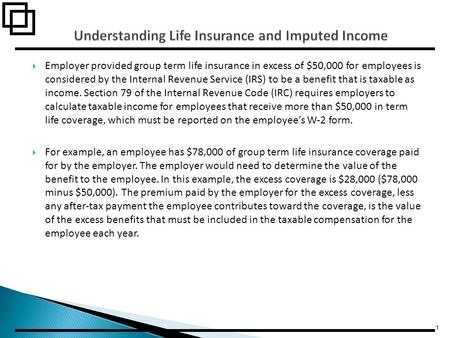

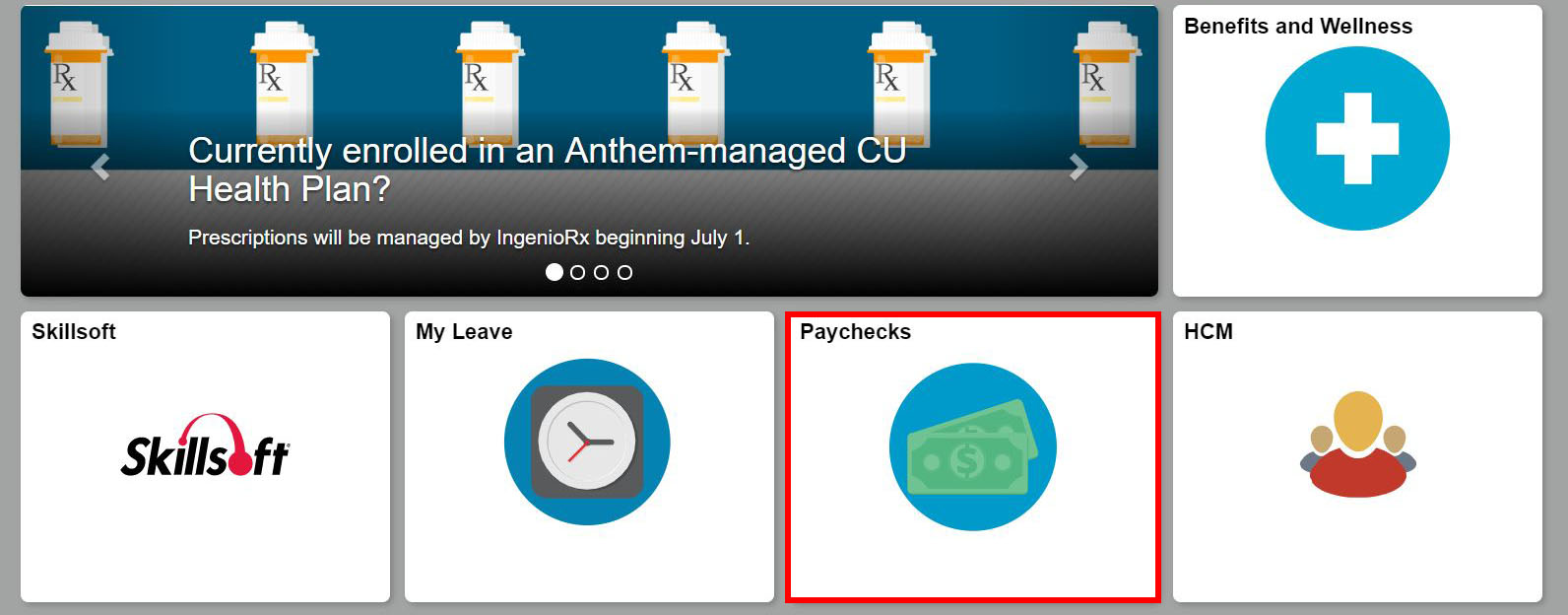

If you provide group term life insurance to your employees you might need to think about imputed income.

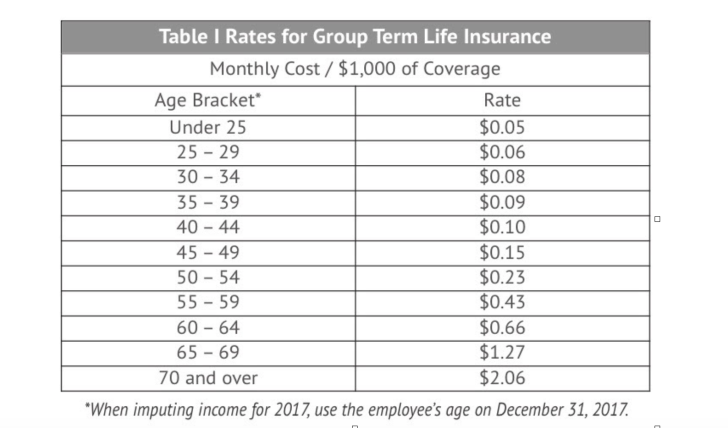

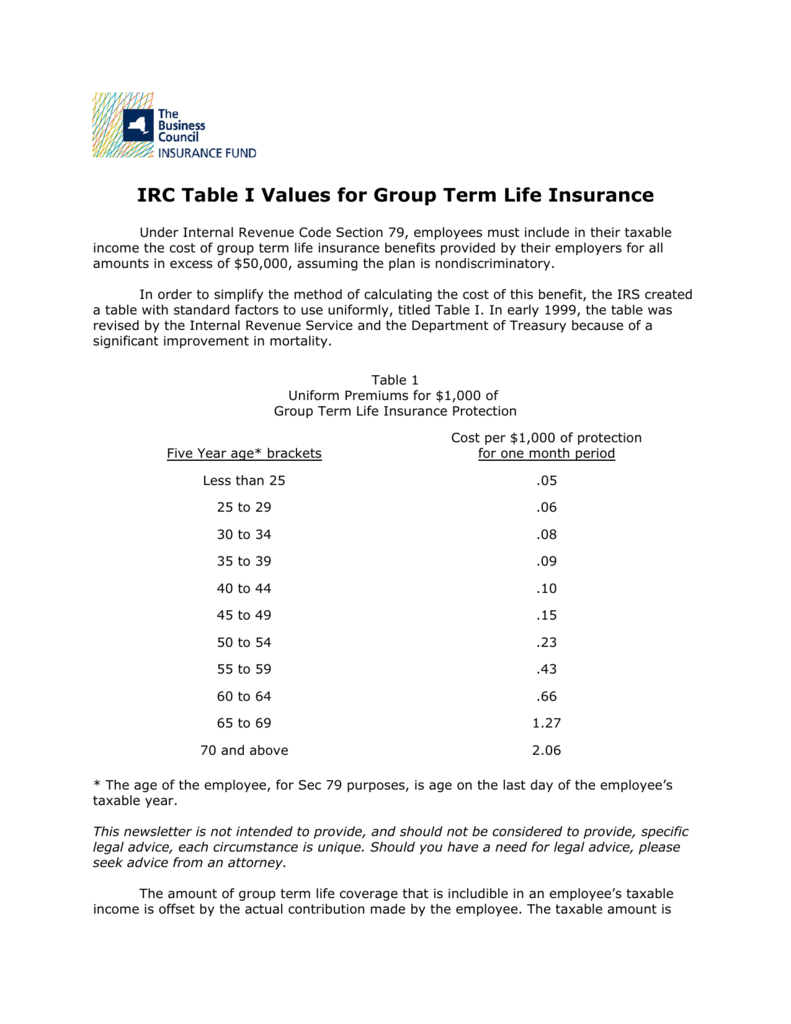

Imputed life insurance. The imputed income occurs when individuals with more than 50000 of life coverage volume insurance pay less for the coverage than the irs has determined to be worth as per the. Life insurance imputed income is a commonly used phrase. Imputed income amounts for basic and voluntary life plans are calculated using the volume of coverage on the plan v and an age banded rate r which is determined by the irs using the employees age on the last day of the employees tax year.

So what is it and how does it work. Youre probably familiar with the concept of providing pre tax benefits to your employees such as. It applies whenever you provide an employee more than 50000 worth of life insurance.

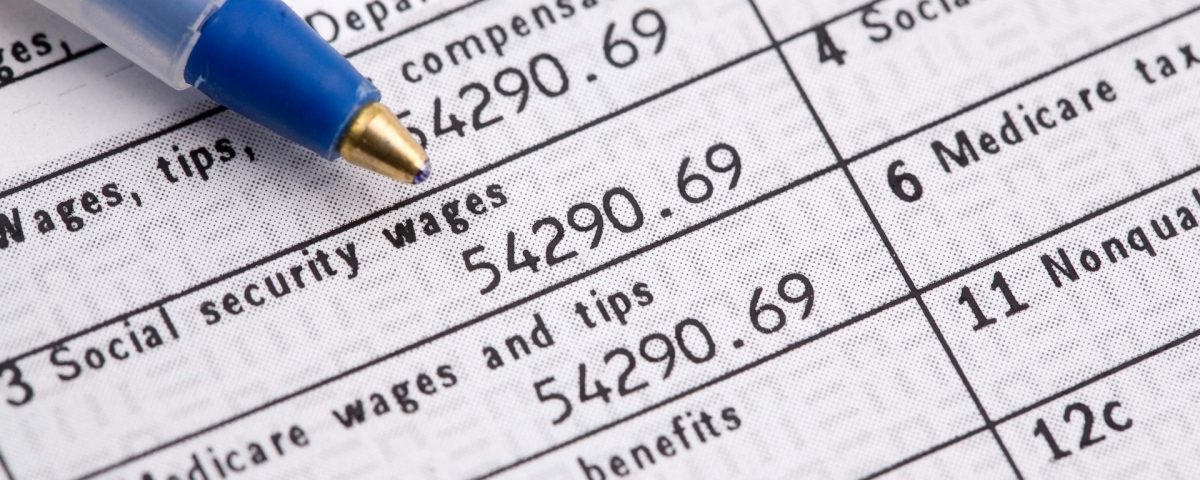

Imputed income is the dollar value that irs puts on the amount of group term life insurance coverage in excess of 50000. Use this form to calculate how much imputed income you will have. The cost of employer provided group term life insurance on the life of an employees spouse or dependent paid by the employer is not taxable to the employee if the face amount of the coverage does not exceed 2000.

However very few people understand what it means. The information below offers a high level overview of imputed income for group term life insurance group voluntary term life insurance and dependent term life insurance. Understanding and managing imputed income for group term life insurance is difficult for benefit administrators particularly those without good payroll software or services.

This coverage is excluded as a de minimis fringe benefit. If you have additional questions regarding. For your information it describes the value of benefit or service that the irs treats as income.

So life insurance imputed income refers to any amount paid on the cover above 50000. The taxes on the imputed income are deducted from your biweekly paycheck. Group term life insurance imputed income worksheet msk paid basic life insurance coverage above 50000 causes taxable imputed income on the value of the coverage.

This is referred to as imputed income and a majority of people who carry group life insurance have no clue that imputed income even exists until they file their taxes and they are asked to include the imputed income from their group life plans.

Employer Provided Group Term Life Insurance In Excess Of 50 000

Employer Provided Group Term Life Insurance In Excess Of 50 000

How To Set Up Sap Hcm Configuration For Imputed Income Calculation

How To Set Up Sap Hcm Configuration For Imputed Income Calculation

Group Term Life Insurance Table I Straddle Testing And Imputed

Group Term Life Insurance Table I Straddle Testing And Imputed

Imputed Income Issues For Employers Leavitt Group News

Imputed Income Issues For Employers Leavitt Group News

Employer Provided Group Term Life Insurance In Excess Of 50 000

Employer Provided Group Term Life Insurance In Excess Of 50 000

Does Imputed Income Affect Your Contributory Life Insurance Plan

Does Imputed Income Affect Your Contributory Life Insurance Plan

What Is Imputed Income Payroll Definition Examples

What Is Imputed Income Payroll Definition Examples

Life Insurance Patti Nash Objectives Identify Different Methods

Life Insurance Patti Nash Objectives Identify Different Methods

How To Set Up Sap Hcm Configuration For Imputed Income Calculation

How To Set Up Sap Hcm Configuration For Imputed Income Calculation

Depositor And Insurance Services Imputed Interest Received

Depositor And Insurance Services Imputed Interest Received

Setting Up Group Term Life Insurance In The U S

Setting Up Group Term Life Insurance In The U S

Section 79 Employer Paid Term Life Ghb Insurance

Section 79 Employer Paid Term Life Ghb Insurance

Imputed Income Issues For Employers Leavitt Group News

Imputed Income Issues For Employers Leavitt Group News

Group Life Insurance Group Life Insurance Imputed Income

Group Life Insurance Group Life Insurance Imputed Income

Group Life Insurance Group Life Insurance Imputed Income

Group Life Insurance Group Life Insurance Imputed Income

How Imputed Income Reporting Works With Your Contributory Life

How Imputed Income Reporting Works With Your Contributory Life

Golocalprov Smart Benefits Imputed Income For Group Term Life

Golocalprov Smart Benefits Imputed Income For Group Term Life

To Have Access To Irc Table I Values For Group Term Life Insurance

To Have Access To Irc Table I Values For Group Term Life Insurance

Comments

Post a Comment