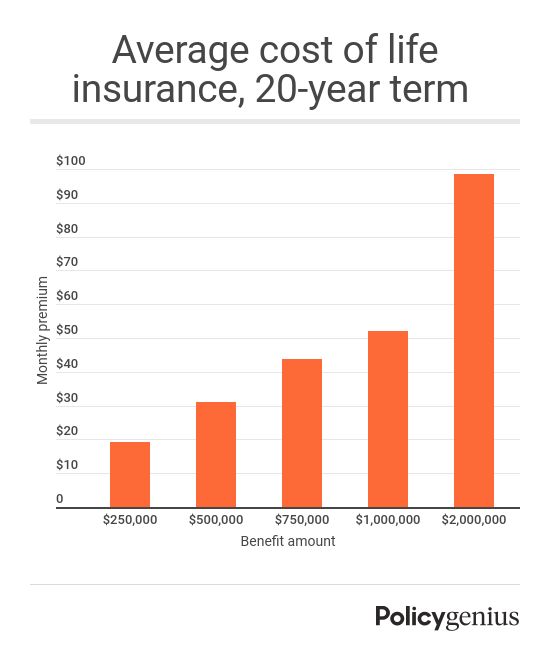

For example one may purchase a decreasing term life insurance policy for a period of 20 years at a premium of 150 per month. Life insurance terminology doesnt have to be confusing.

After that period expires coverage at the previous rate of premiums is no longer guaranteed and the client must either forgo coverage or potentially obtain further coverage with different payments or conditions.

Increasing term life insurance definition. Decreasing term insurance a term life insurance policy in which the policyholder pays a constant premium but the benefit decreases over time either on a monthly quarterly or yearly basis. Decreasing term life insurance policies rarely make sense especially since level term life insurance is so affordable. What is decreasing term life insurance.

At first the benefit may be as high. Decreasing term insurance is a more affordable option than whole life or universal life insurancethe death benefit is designed to mirror the amortization schedule of a mortgage or other high. There is no savings component as found in a whole life insurance product.

Like some of the other policies that we have examined increasing term life insurance can either be added as a rider or can be part of the policy itself. Term life insurance or term assurance is life insurance that provides coverage at a fixed rate of payments for a limited period of time the relevant term. Premiums normally remain the same throughout the life of the policy which can range from one to 30 years.

When choosing a life insurance policy two of the main types of plans available are term life insurance and whole life insurance. Increasing term life insurance. But if your primary reason to purchase life insurance is to ensure that one debt is covered in case you die a decreasing term policy could be an option that is if you can find a carrier to write you one.

Definition of increasing term insurance. The policy is commonly referred to as a return of premium benefit but this benefit is limited to twenty years. The idea is that the amount of cover paid out goes down each year for the length of the policy eventually finishing at 0.

Term life policies have no value other than the guaranteed death benefit. The policys purpose is to give insurance to. Decreasing term life insurance is a type of term life insurance whose death benefit decreases at a set rate as the policy matures.

Another term for a term life insurance policy a level term life policy is where the premiums and death benefit remain the same for the duration of the contract. The decrease in the death benefit may occur monthly or annually. Decreasing term life cover is designed to help your loved ones pay off your financial commitments such as a repayment mortgage loans or credit card balances if you pass away during the term of the policy.

A term policy that maintains the same premium throughout the term and has an increasing death benefit.

Finance Should Your Life Insurance Policy Be Written In Trust 27408

Finance Should Your Life Insurance Policy Be Written In Trust 27408

Types Of Term Life Insurance Which Is Right For You

Types Of Term Life Insurance Which Is Right For You

Whole Life Insurance How It Works

Term Insurance Best Term Plans Policy Online In India 2020

Term Insurance Best Term Plans Policy Online In India 2020

Paid Up Additions Maximizing Cash Value Accumulation Growth

Paid Up Additions Maximizing Cash Value Accumulation Growth

Medical Tests That You Have To Undergo While Buying A Term Plan In

Medical Tests That You Have To Undergo While Buying A Term Plan In

Term Insurance Best Term Plans Policy In India 2020 21 Icici

Term Insurance Best Term Plans Policy In India 2020 21 Icici

/GettyImages-521652451-5ac38723119fa8003751e793.jpg) Best Term Life Insurance Policies Of 2020

Best Term Life Insurance Policies Of 2020

A Totally Not Boring Guide To Life Insurance Wealthsimple

A Totally Not Boring Guide To Life Insurance Wealthsimple

Types Of Term Life Insurance Which Is Right For You

Types Of Term Life Insurance Which Is Right For You

Term Insurance Best Term Insurance Plan Policy In India Hdfc

Term Insurance Best Term Insurance Plan Policy In India Hdfc

Whole Life Insurance How It Works

Whole Life Insurance How It Works

9 Things About Term Insurance You Always Wanted To Know

9 Things About Term Insurance You Always Wanted To Know

Considering Term Life Insurance Advantage Insurance Advisors

Considering Term Life Insurance Advantage Insurance Advisors

Term Life Vs Whole Life Insurance Which Type Of Life Insurance

Term Life Vs Whole Life Insurance Which Type Of Life Insurance

Term Life Insurance Definition

Term Life Insurance Definition

Best Life Insurance Companies For 2020 The Simple Dollar

Best Life Insurance Companies For 2020 The Simple Dollar

Understanding Increasing Money Back Feature Of Exide Life My Money

Understanding Increasing Money Back Feature Of Exide Life My Money

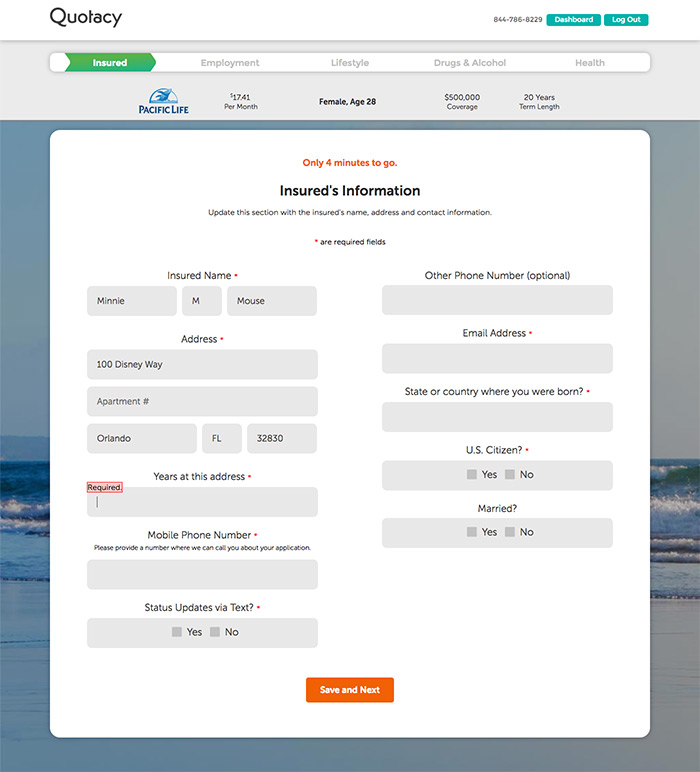

Can I Buy Life Insurance On Someone Else Quotacy

Can I Buy Life Insurance On Someone Else Quotacy

:max_bytes(150000):strip_icc()/GettyImages-1083840976-a828869589624ed28316b9352c7aff11.jpg)

Comments

Post a Comment