Term life insurance generally provides protection for a set period of time while permanent insurance such as whole and universal life provides lifetime coverage. Liberty mutual offers three kinds of life insurance plans designed to meet different needs.

Life Insurance Online Discover Best Life Cover Plans Policy In

Life Insurance Online Discover Best Life Cover Plans Policy In

Term life insurance pays a specific lump sum to your loved ones for a specified period of time usually from one to 20 yearsif you stop paying premiums the insurance stops.

Insurance for life. Life insurance is a simple concept. Typically life insurance is chosen based on the needs and goals of the owner. But it can be confusing and many people opt out of the safety net life insurance creates because they dont understand how it works as part of a financial plan.

Life insurance or life assurance especially in the commonwealth of nations is a contract between an insurance policy holder and an insurer or assurer where the insurer promises to pay a designated beneficiary a sum of money the benefit in exchange for a premium upon the death of an insured person often the policy holder. Help ease the financial burden for your loved ones with colonial penns guaranteed acceptance life insurance. Pay now to protect your family later.

Then we narrowed the field by setting high standards to be considered for our top picks. Life insurance can provide peace of mind that your loved ones would be financially protected if you were to pass away. Life insurance provides financial security by replacing lost income and covering expenses.

Apply for this lifetime coverage now to lock in a premium amount that is guaranteed to never increase at a price that fits your budget. Life insurance policies provide beneficiaries with lump sum payments when the insured party passes away or after a specific period of time has passed. Life insurance comes in two main types term and permanent which may both be available through your workplace.

The lump sum payout they would receive can be used to pay vital bills like a mortgage or rent or to help with the cost of bringing up children. To find the best life insurance companies we started with a list of over 40 of the largest insurers in the us. Myths about life insurance.

Here are the top three myths about life insurance. Browse below to understand if term life whole life or fixed annuitiesfixed income is best suited for you and your family. Its important to note that death benefits from all types of life insurance are generally income tax.

The point of using lorem ipsum text is that it has a more or less normal distribution of letters as opposed to using content here content here making it look like english. Life insurance is too expensive. If youre looking for a life insurance policy weve got you covered.

Haven Life Uses Ai To Underwrite Life Insurance For Noncitizens

Haven Life Uses Ai To Underwrite Life Insurance For Noncitizens

How Much Life Insurance Do You Need It Depends On These Factors

How Much Life Insurance Do You Need It Depends On These Factors

1 000 000 No Medical Exam Life Insurance

1 000 000 No Medical Exam Life Insurance

Choosing A Life Insurance Policy Video Lesson Transcript

Choosing A Life Insurance Policy Video Lesson Transcript

Introducing Life Insurance For Smokers

Introducing Life Insurance For Smokers

Family Life Insurance Planning Guide By Hdfc Life

Family Life Insurance Planning Guide By Hdfc Life

Life Insurance You Can Feel Good About Woodmenlife Org

Life Insurance You Can Feel Good About Woodmenlife Org

Life Insurance Policies Term Vs Permanent Redemption Wines

Life Insurance Policies Term Vs Permanent Redemption Wines

How Life Insurance Comparison Can Save You Cost Madailylife

How Life Insurance Comparison Can Save You Cost Madailylife

Introducing Life Insurance For Smokers

Introducing Life Insurance For Smokers

Life Insurance For Seniors Over 70 What They Don T Tell You

Life Insurance For Seniors Over 70 What They Don T Tell You

Life Insurance Over 50 Years Old See Quotes Best Companies

Life Insurance Over 50 Years Old See Quotes Best Companies

Introduction Of A Life Term Insurance Policy For All Employees

Introduction Of A Life Term Insurance Policy For All Employees

How To Get A Life Insurance For My Mom Quora

I Am 28 Years Old And Want To Buy Rs 1 Crore Term Life Insurance

I Am 28 Years Old And Want To Buy Rs 1 Crore Term Life Insurance

How To Get Life Insurance With Multiple Sclerosis 7 Steps With

How To Get Life Insurance With Multiple Sclerosis 7 Steps With

Buy Hdfc Life Click 2 Protect 3d Plus Ideal Term Insurance For

Buy Hdfc Life Click 2 Protect 3d Plus Ideal Term Insurance For

Here S Why Millennials Aren T Buying Life Insurance And Why They

Here S Why Millennials Aren T Buying Life Insurance And Why They

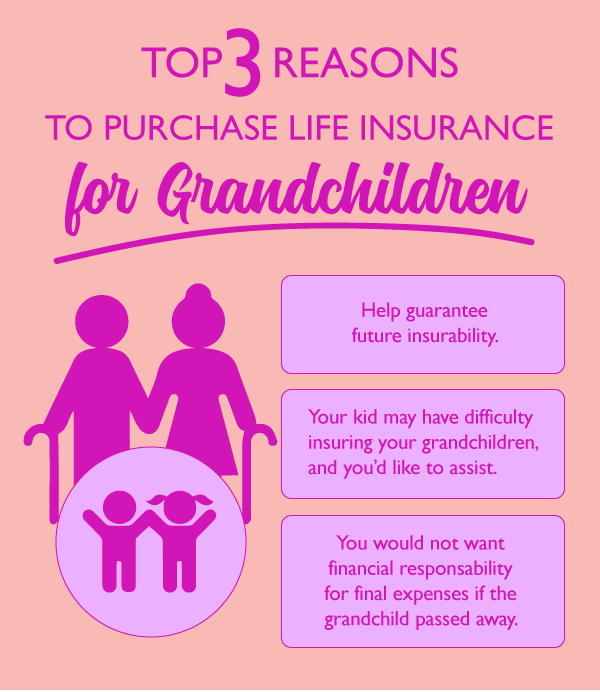

Get Them Grandkids Covered With Life Insurance My Official Guide

Get Them Grandkids Covered With Life Insurance My Official Guide

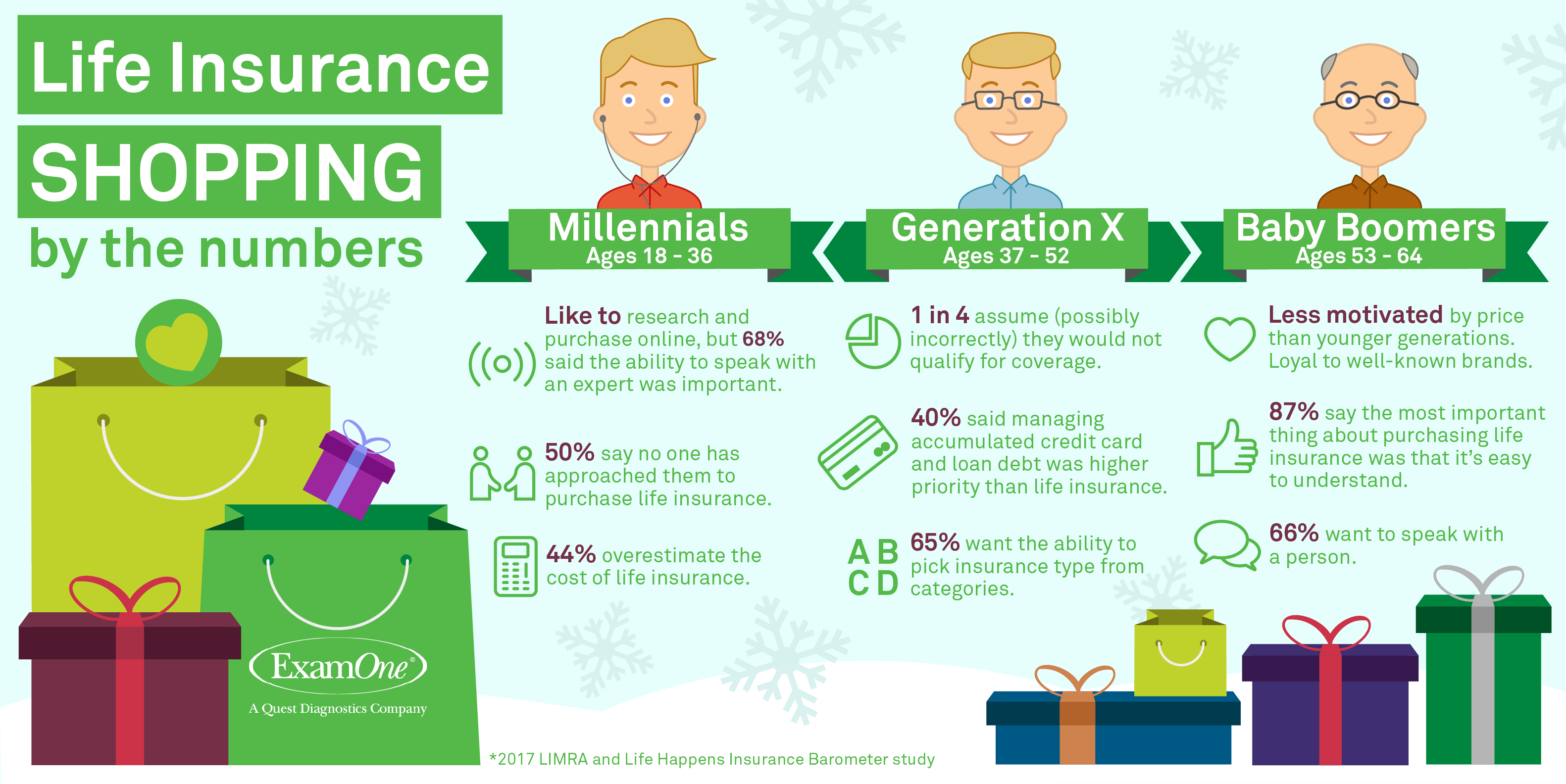

Holiday Shopping For Life Insurance The Purchasing Habits For 3

Holiday Shopping For Life Insurance The Purchasing Habits For 3

Comments

Post a Comment