Estate planningirrevocable life insurance trust forms estate planningirrevocable life insurance trust forms there are three wills and trust documents in this product that can be used for estate tax savings trusts. Irrevocable life insurance trust form if you are looking for the best deals on insurance then our insurance quotes service can provide you with a wide range of options.

Estate Planning A Guide To Understanding Estate Planning Ppt

Estate Planning A Guide To Understanding Estate Planning Ppt

2 the appendix to this chapter includes a sample irrevocable unfunded life insurance trust.

Irrevocable life insurance trust form. As with any form this one is a starting point and must be modified to meet the needs of individual clients. 12 the name of this trust shall be the family insurance trust. This product is in both pdf.

Like most trusts is simply a holding device. Get a quote now. Including but not limited to policies of insurance on my life pursuant to the provisions of this trust agreement in trust for the uses and purposes and subject to the conditions powers and limitations hereinafter set forth.

Irrevocable life insurance trust form if you are looking for quotes on different types of insurance then we can give you insurance quotes that will help you find what you are looking for. The irrevocable life insurance trust is a sophisticated form of tax planning and one which is a frequent subject of new internal revenue service regulations and litiga tion. Irrevocable life insurance trust form if you are looking for the best insurance quotes then our free online service will give you the information you need in no time.

It owns your life insurance policy for you removing it from your estate. Irrevocable life insurance trust form if you are looking for insurance quotes that are fast and reliable then our online service is perfect for you. Life insurance and the drafting of the irrevocable unfunded life insurance trust2 ii.

That means once youve created it and placed an insurance policy inside it you cant take the policy back in your own name. The trust will be the owner and beneficiary of the life insurance policies. The intent of this trust is to remove life insurance policies from the grantors taxable estate if the grantor lives three years after transferring the policies to the trust unless the trust owns the policies from their inception in which case there is no issue.

Accordingly proper practices must be established to meet the criteria of which we are currently aware relating to the ongoing management of the trust. As its name suggests the irrevocable life insurance trust ilit is irrevocable.

:brightness(10):contrast(5):no_upscale()/173867442-56a2ef203df78cf7727b36a1.jpg) What Is An Irrevocable Life Insurance Trust

What Is An Irrevocable Life Insurance Trust

Irrevocable Life Insurance Trust Operating Guide Pdf Free Download

Irrevocable Life Insurance Trust Operating Guide Pdf Free Download

Journal A Road Map To Estate Planning After Tax Reform

Journal A Road Map To Estate Planning After Tax Reform

Revocable Beneficiary Definition

Revocable Beneficiary Definition

Don T Forget To Strategize For Estate Taxes Don T Invest And Forget

Don T Forget To Strategize For Estate Taxes Don T Invest And Forget

The Irrevocable Life Insurance Trust Forms With Drafting Notes

The Irrevocable Life Insurance Trust Forms With Drafting Notes

Sebastian Grassi Checklist For Drafing The Irrevocable Fill

Sebastian Grassi Checklist For Drafing The Irrevocable Fill

20 Printable Sample Irrevocable Living Trust Forms And Templates

20 Printable Sample Irrevocable Living Trust Forms And Templates

Sample Declaration Of Life Insurance Trust Form 8ws Templates

Sample Declaration Of Life Insurance Trust Form 8ws Templates

A Guide To The Different Types Of Trusts Smartasset Com

A Guide To The Different Types Of Trusts Smartasset Com

Irrevocable Life Insurance Trust Ilit The Wealth Counselor

Irrevocable Life Insurance Trust Ilit The Wealth Counselor

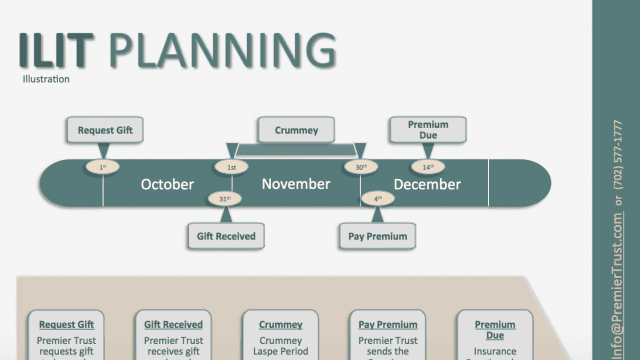

Estate Planning Toolkit Archives Premier Trust

Estate Planning Toolkit Archives Premier Trust

5 Rescue Techniques To Remove A Life Policy From An Ilit Bsmg

5 Rescue Techniques To Remove A Life Policy From An Ilit Bsmg

Irrevocable Life Insurance Trust Ilit The Wealth Counselor

Irrevocable Life Insurance Trust Ilit The Wealth Counselor

What Is An Irrevocable Beneficiary

What Is An Irrevocable Beneficiary

Northwestern Mutual Life Insurance Application

Northwestern Mutual Life Insurance Application

Common Mistakes In Life Insurance Arrangements

What Is An Irrevocable Life Insurance Trust Northwestern Mutual

What Is An Irrevocable Life Insurance Trust Northwestern Mutual

6 Surprising Facts About Living Revocable Trust

6 Surprising Facts About Living Revocable Trust

Understanding A Joint Trust Vs An Individual Trust The Mckenzie

Understanding A Joint Trust Vs An Individual Trust The Mckenzie

Overview Of Different Types Of Trusts Asset Protection Pages

Overview Of Different Types Of Trusts Asset Protection Pages

Comments

Post a Comment