After your death your named beneficiaries deal directly with the insurance company to receive the money. When life insurance is part of an estate a life insurance policy has one or more designated beneficiaries if the decedent completed a beneficiary designation form for the policy before their death.

Estate Planning Personal Financial Planning Lecture Slides

Estate Planning Personal Financial Planning Lecture Slides

When life insurance payouts end up in probate.

Is life insurance part of estate after death. Life insurance is only part of an estate if the policy is not left to a designated beneficiary. For those estates that will owe taxes whether life insurance proceeds are included as part of the taxable estate depends on the ownership of the policy at the time of the insureds death. You can collect policy death benefits by sending the original death certificate and the original life insurance policy to the insurer if youre named as the beneficiary.

It does not matter if it is included in a will or not. A person might bequeath some of his assets to certain beneficiaries and simply state that he gives the. First if the death benefit is paid to the estate of the insured then the whole amount of the death benefit is included in the estate and subject to estate tax.

As a result most life insurance policy payouts do not require involvement from probate even if probate is required for other property in the deceased persons estate. I am interested in the case of a bankrupt estate. A life insurance inheritance is not usually considered income for tax purposes.

The death benefits paid on life insurance policies are subject to estate tax in two situations. They typically dont become part of the decedents probate estate. If at least one of the designated beneficiaries survives the decedent the life insurance proceeds pass directly to the beneficiary outside of probate.

If after someone dies you receive life insurance as the beneficiary is the estate entitled to any of that money. Are there cases where the life insurance money can be included in the estate and therefore be required for repayment of debts of the deceased. Many times people do not name everything they own in their wills.

If you own a life insurance policy on yourself the death benefit will be part of your estate. The distinction matters because the estate assets can be used to pay the outstanding debts of the deceased and larger estates are subject to estate tax. If someone else owns the policy the benefit will not be included in your estate.

Can Medicaid Take Life Insurance After Death Life Ant

Can Medicaid Take Life Insurance After Death Life Ant

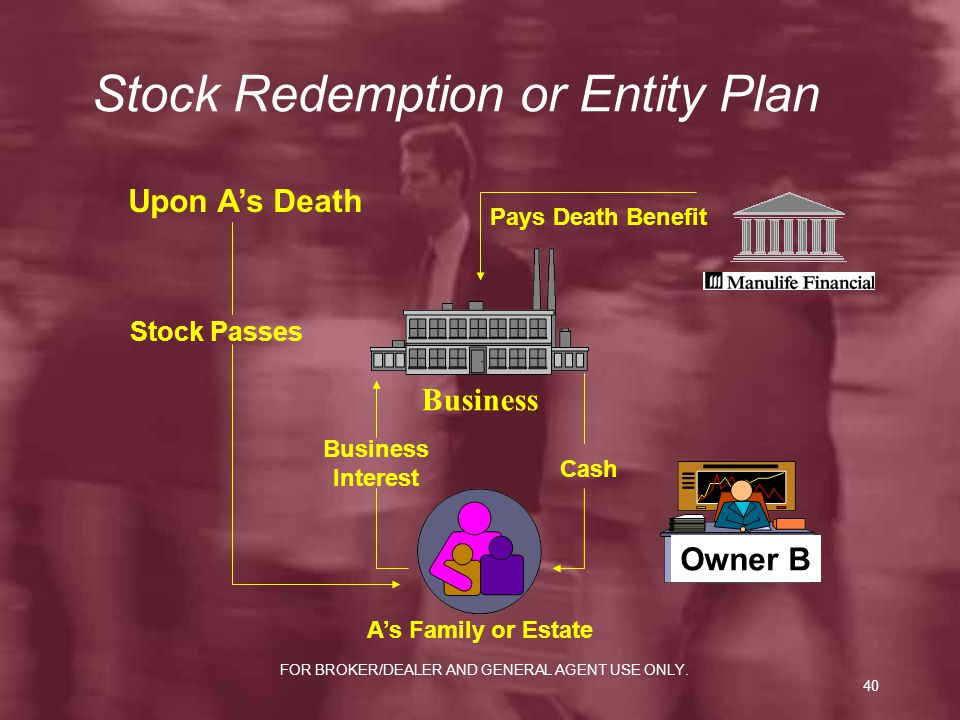

Business Planning Using Life Insurance Ppt Download

Business Planning Using Life Insurance Ppt Download

Solved Justin Is The Grantor Of An Ilit When He Dies Hi

Solved Justin Is The Grantor Of An Ilit When He Dies Hi

Why Life Insurance Is So Valuable And How It Can Improve Your

Why Life Insurance Is So Valuable And How It Can Improve Your

Mistakes To Avoid When You Own Life Insurance Investopedia

Mistakes To Avoid When You Own Life Insurance Investopedia

/how-to-decide-if-you-need-life-insurance-57afbb525f9b58b5c231cc04.jpg) When Should You Have Life Insurance What Are The Different Options

When Should You Have Life Insurance What Are The Different Options

Who Needs Life Insurance Hint It Isn T Just For Parents

Who Needs Life Insurance Hint It Isn T Just For Parents

Irrevocable Life Insurance Basics Trust Momentum Transamerica

Irrevocable Life Insurance Basics Trust Momentum Transamerica

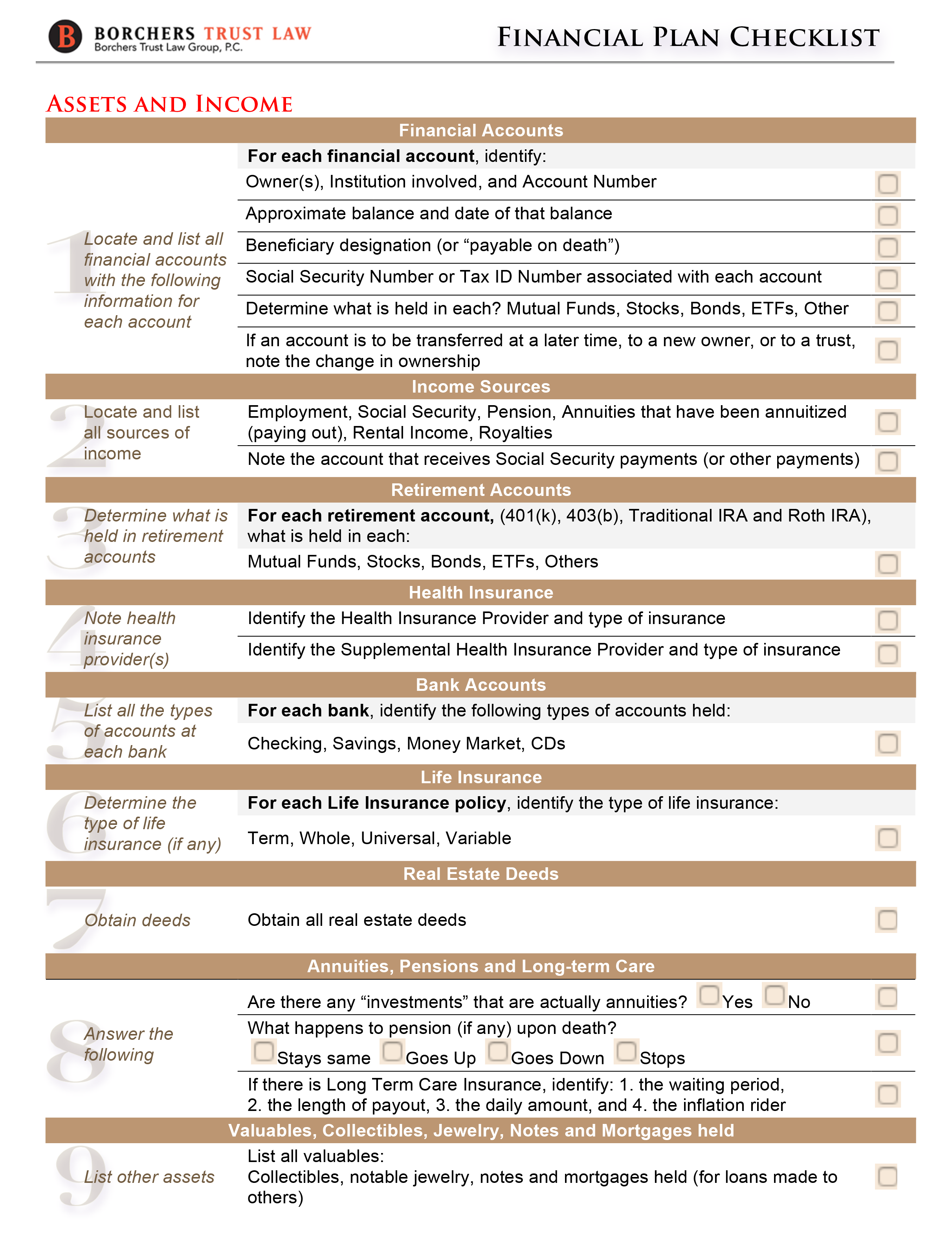

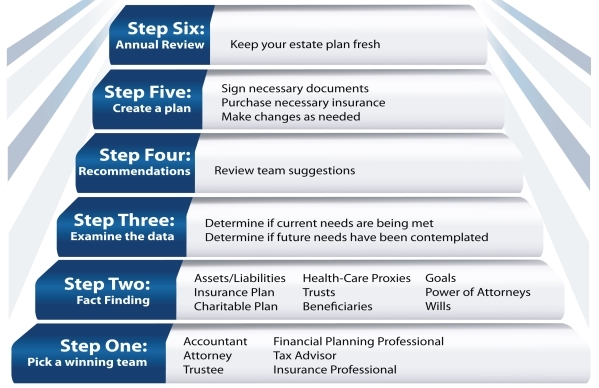

A Financial Plan Checklist An Essential Estate Planning Tool

A Financial Plan Checklist An Essential Estate Planning Tool

Naming A Life Insurance Beneficiary Or Estate By Jason Martin

Naming A Life Insurance Beneficiary Or Estate By Jason Martin

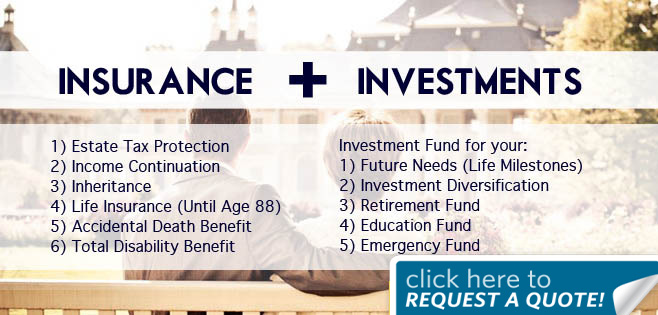

Estate Planning Using Life Insurance Moneytalkph

Estate Planning Using Life Insurance Moneytalkph

Why Whole Life Insurance Is A Bad Investment Mom And Dad Money

Why Whole Life Insurance Is A Bad Investment Mom And Dad Money

Life Insurance Policy Loans Tax Rules And Risks

Life Insurance Policy Loans Tax Rules And Risks

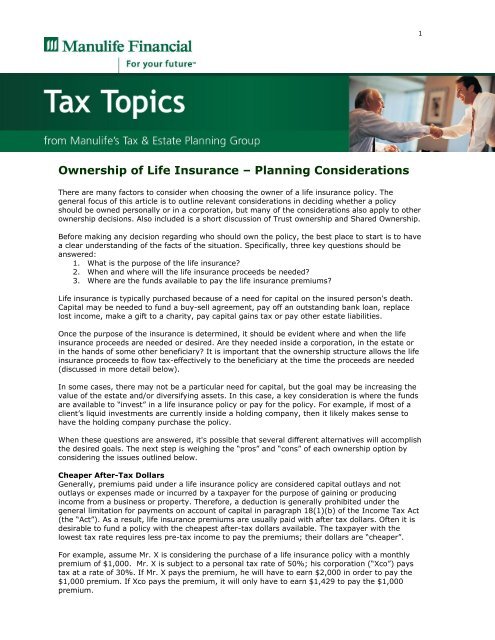

Ownership Of Life Insurance Repsource Manulife Financial

Ownership Of Life Insurance Repsource Manulife Financial

4 Tax Issues To Consider When You Close An Estate Marketwatch

4 Tax Issues To Consider When You Close An Estate Marketwatch

Life Insurance Estate Planning

Life Insurance Estate Planning

Beneficiary Designation A Predetermined Settlement Option

Beneficiary Designation A Predetermined Settlement Option

Mortgages Life Insurance How Do They Fit Together Outline

Mortgages Life Insurance How Do They Fit Together Outline

Life Insurance As Part Of An Estate When To Use A Will Or Trust

Life Insurance As Part Of An Estate When To Use A Will Or Trust

Comments

Post a Comment