If you buy a life insurance policy on your own or through your employer your premiums are probably paid with after tax dollars. Real rate is based on your application and third party data obtained during underwriting.

Tax Benefits On Insurance Policies Cheap Term Life Insurance

Tax Benefits On Insurance Policies Cheap Term Life Insurance

Learn how taxes affect your specific situation.

Is life insurance policy taxable. Generally speaking when the beneficiary of a life insurance policy receives the death benefit this money is not counted as taxable income and the beneficiary does not have to pay taxes on it. As we mentioned earlier youll have a taxable gain if you cash in a life insurance policy and there is a cash value that is bigger than the premiums you paid. Normally the payout from life insurance policy to the beneficiaries is not counted as taxable income but there are some exceptions.

If a policy is combined with a non refund life annuity contract where a single premium is equal to the face value of the insurance is paid then the exclusion does not apply. In most cases life insurance proceeds are not taxable so your beneficiaries should get the full amount available. Is return of premium life insurance taxable.

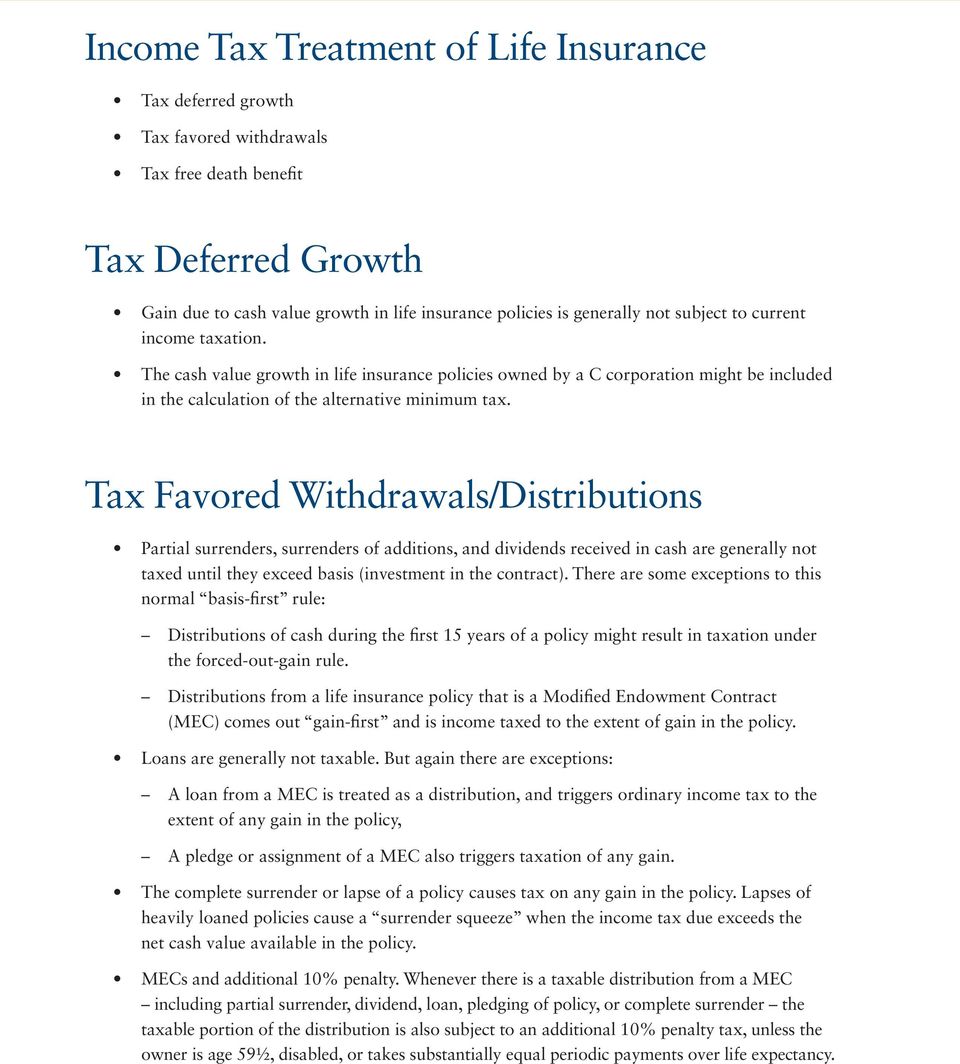

However any interest you receive is taxable and you should report it as interest received. See topic 403 for more information about interest. Generally life insurance proceeds you receive as a beneficiary due to the death of the insured person arent includable in gross income and you dont have to report them.

The taxation of life insurance proceeds depends on several factors including whether you paid your insurance premiums with pre or after tax dollars. Return of premium life insurance life insurance policies do just what they say. Most of the time proceeds arent taxable.

Another example of taxable life insurance interest would be a mutual insurance company issued policy issued. Life insurance isnt a fun topic to think about but it can protect your loved ones in the event you were to pass away. For example if the.

Getting a large lump sum of money usually incurs taxes think lotto winnings for example. But there are certain. Life insurance can give your loved ones financial security should you die.

Haven term is a term life insurance policy dtc 042017 and icc17dtc in certain states including nc issued by massachusetts mutual life insurance company massmutual springfield ma 01111 0001 and offered exclusively through haven life insurance agency llc. When the policy is up the premiums paid over the previous decades are returned to the policyholder.

Life Insurance Policies Life Insurance Policies Taxable Income

Life Insurance Policies Life Insurance Policies Taxable Income

Life Insurance Policies Are Life Insurance Policies Taxed

Life Insurance Policies Are Life Insurance Policies Taxed

Today S Lecture 14 Life Insurance How Life Insurance Works

Today S Lecture 14 Life Insurance How Life Insurance Works

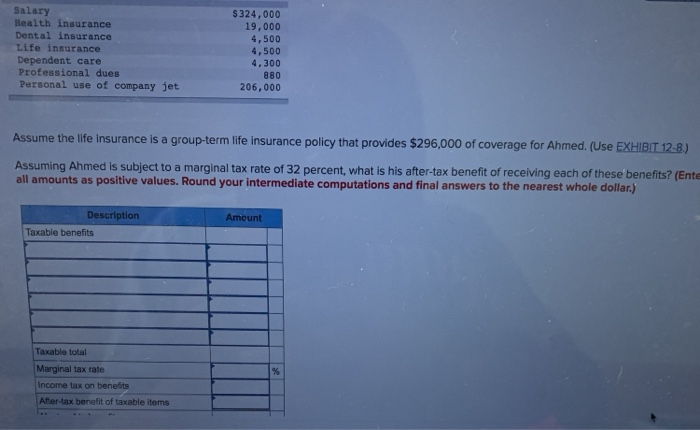

Salary Health Insurance Dental Insurance Life Insu Chegg Com

Salary Health Insurance Dental Insurance Life Insu Chegg Com

How Much Does Life Insurance Cost

How Much Does Life Insurance Cost

How Is The Sale Of A Life Insurance Policy Taxed Life

How Is The Sale Of A Life Insurance Policy Taxed Life

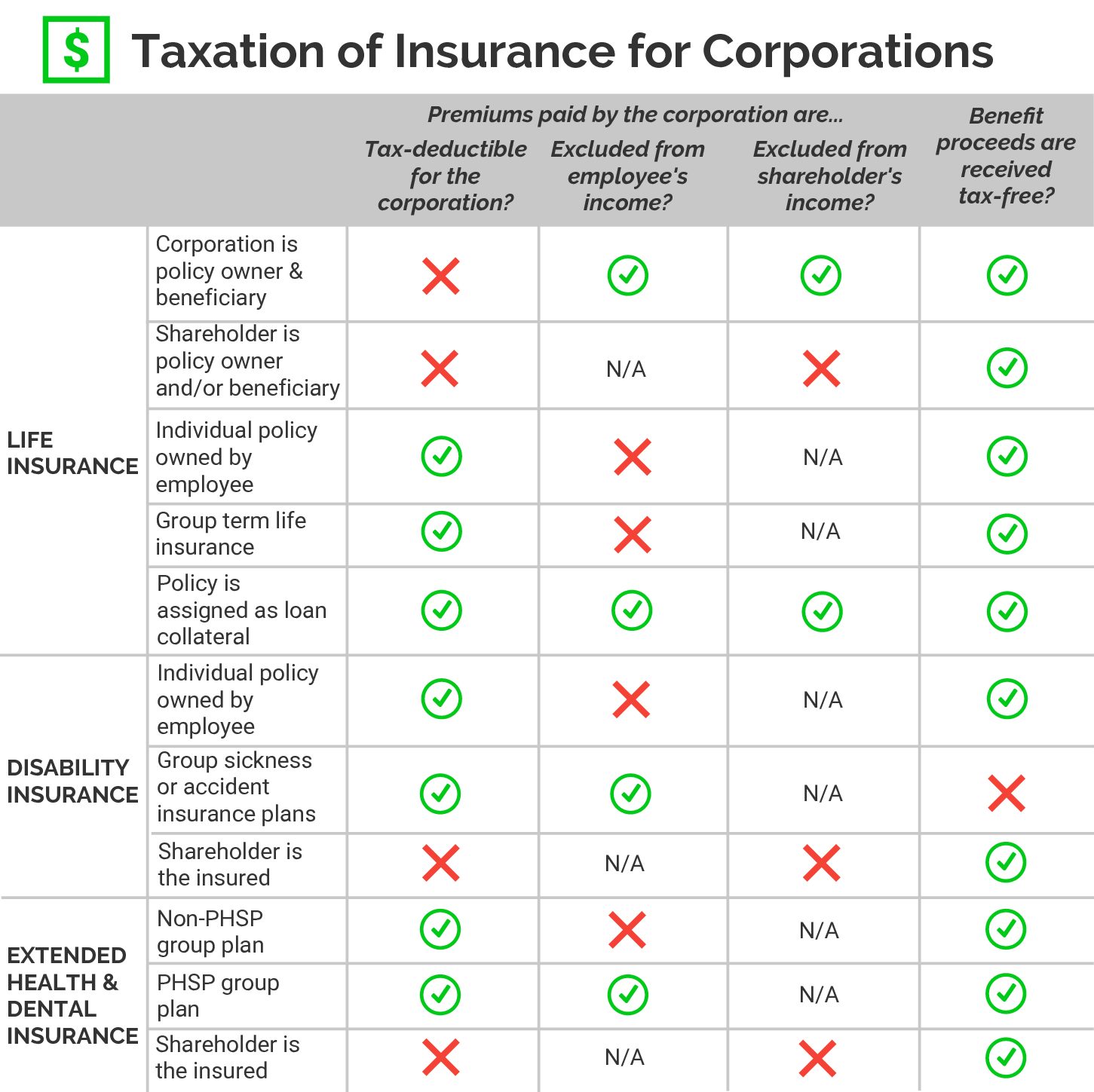

Taxation Of Insurance For Corporations Kelowna Accounting Solutions

Taxation Of Insurance For Corporations Kelowna Accounting Solutions

Tax Policy Taxation Of Single Premium Life Insurance Ggd 88 9br

Tax Policy Taxation Of Single Premium Life Insurance Ggd 88 9br

Greater Certainty About The Taxation Of Unit Linked Life Insurance

Greater Certainty About The Taxation Of Unit Linked Life Insurance

Taxable Benefits Taxable Benefits Life Insurance Premiums

Taxable Benefits Taxable Benefits Life Insurance Premiums

Are Life Insurance Payouts Taxable Life Ant

Are Life Insurance Payouts Taxable Life Ant

Sell Life Insurance Policy Taxable Archives Hamariwib

Sell Life Insurance Policy Taxable Archives Hamariwib

Rushing To Buy Insurance Now Don T End Up With A Wrong Policy

Rushing To Buy Insurance Now Don T End Up With A Wrong Policy

Not Full Amount But Only Difference Is Liable For Taxation

Not Full Amount But Only Difference Is Liable For Taxation

Is Life Insurance Taxable True Blue Life Insurance

Is Life Insurance Taxable True Blue Life Insurance

Is A Life Insurance Payout Considered Taxable Income My Senior

Is A Life Insurance Payout Considered Taxable Income My Senior

Whether Your Life Insurance Policy Is Eligible For Tax Saving

Whether Your Life Insurance Policy Is Eligible For Tax Saving

What Is Cash Surrender Value In Life Insurance Mason Finance

What Is Cash Surrender Value In Life Insurance Mason Finance

Solved This Year Janelle Received 300 000 In Life Insur

Solved This Year Janelle Received 300 000 In Life Insur

Difference Between Cash Value And Face Value In Life Insurance

Difference Between Cash Value And Face Value In Life Insurance

Comments

Post a Comment