However there are some circumstances when theyre subject to taxation such as when they are paid in installments or exceed a certain threshold. If you have employer provided life insurance known as group life insurance any coverage over 50000 is treated as taxable income but any amount under 50000 is not taxed.

Solved Jdd Corporation Provides The Following Benets To Its

In quebec premiums for health and dental insurance are also considered a taxable benefit.

Is life insurance a taxable benefit. See topic 403 for more information about interest. This is the only tax benefit that is offered by all types of life insurance policies including term life and the various types of permanent life insurance. However there are situations when money from a tax benefit may get taxed.

Life insurance including death benefits is usually not taxable. However any interest you receive is taxable and you should report it as interest received. However the death benefit could be taxable in a few situationsmostly for wealthy policyholders who use the word estate in their inheritance planning.

Are life insurance proceeds taxable. Group life insurance can be a nice addition to your benefits package especially if its free or nearly free. Generally no the death benefit or payout or proceeds of a life insurance policy isnt taxable most of the time.

This most obvious tax benefit of life insurance is the fact that the beneficiaries of a life insurance death benefit do not pay income tax on the proceeds. Life insurance can give your loved ones financial security should you die. That money isnt considered taxable income.

Generally speaking when the beneficiary of a life insurance policy receives the death benefit this money is not counted as taxable income and the beneficiary does not have to pay taxes on it. Generally life insurance proceeds you receive as a beneficiary due to the death of the insured person arent includable in gross income and you dont have to report them. Likewise f the employee is the benificiary then its a taxable benefit which should be reported on form p11d.

It was always my understanding that if an employer is the beneficiary of a life insurance policy then no p11d benefit will arise. Employer paid premiums for group life insurance dependant life insurance accident insurance and critical illness insurance are taxable benefits and the amounts paid on your behalf will be added to your taxable income. Life insurance death benefit proceeds are typically tax free lump sums of money paid to beneficiaries.

In most cases life insurance proceeds are not taxable so your beneficiaries should get the full amount available.

Whole Life Insurance The Essential Guide

Whole Life Insurance The Essential Guide

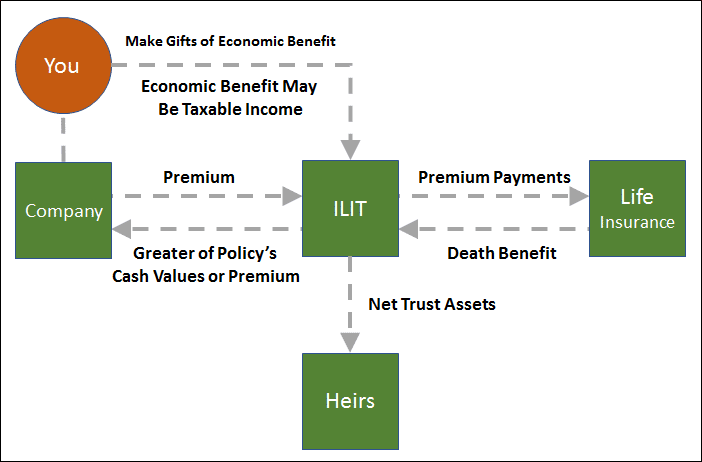

Split Dollar Life Insurance Using Economic Benefit Or Loan Regime

Split Dollar Life Insurance Using Economic Benefit Or Loan Regime

How Is A Life Insurance Death Benefit Paid Out Northwestern Mutual

How Is A Life Insurance Death Benefit Paid Out Northwestern Mutual

When Life Insurance Becomes Taxable Leasha West Medium

When Life Insurance Becomes Taxable Leasha West Medium

Split Dollar Life Insurance Using Economic Benefit Or Loan Regime

Split Dollar Life Insurance Using Economic Benefit Or Loan Regime

Life Insurance Through Super A Definitive Guide

Life Insurance Through Super A Definitive Guide

Understanding Whole Life Insurance Dividend Options

Understanding Whole Life Insurance Dividend Options

Life Insurance Module By Ross Boquiren On Prezi Next

Life Insurance Module By Ross Boquiren On Prezi Next

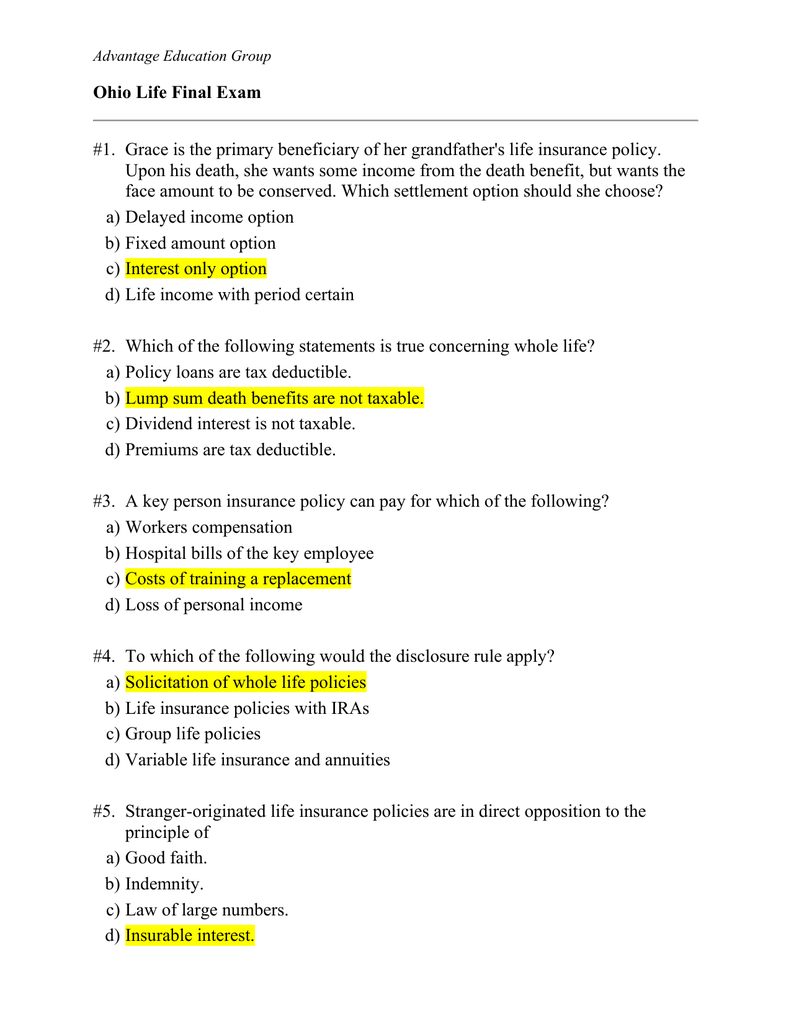

Ohio Life Final Exam Advantage Education Group Take Pages

Ohio Life Final Exam Advantage Education Group Take Pages

Fringe Benefits Taxable Vs Non Taxable Benefits Times Of India

Fringe Benefits Taxable Vs Non Taxable Benefits Times Of India

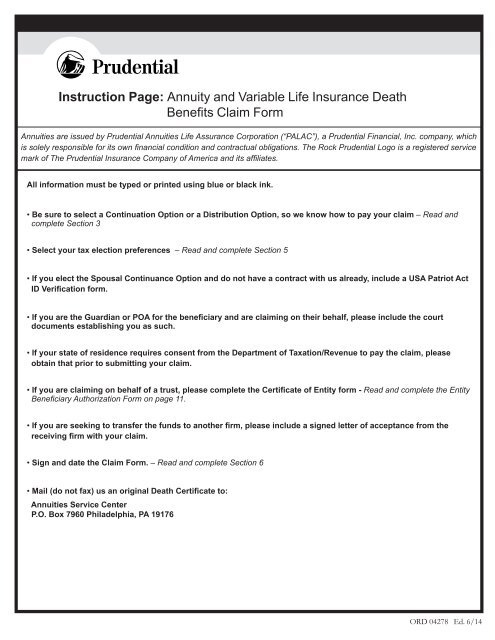

Annuity And Variable Life Insurance Death Benefits Claim Form

Annuity And Variable Life Insurance Death Benefits Claim Form

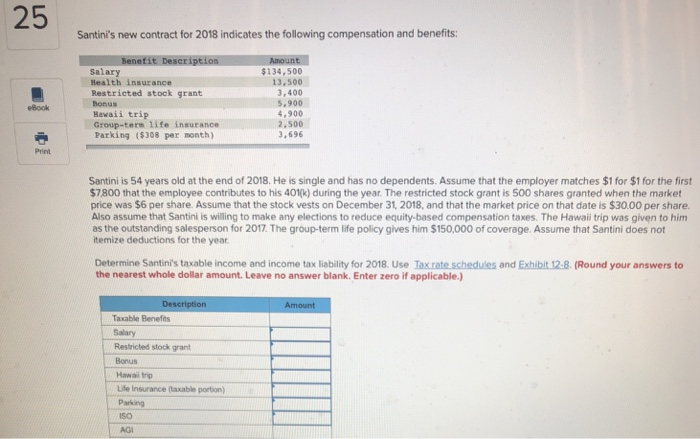

Solved 25 Santini S New Contract For 2018 Indicates The F

Solved 25 Santini S New Contract For 2018 Indicates The F

Taxation Of Critical Illness And Disability Insurance Living

Taxation Of Critical Illness And Disability Insurance Living

Types Of Death Benefits Generally Excluded From Gross Income Ppt

Types Of Death Benefits Generally Excluded From Gross Income Ppt

Tax Benefits On Insurance Policies Cheap Term Life Insurance

Tax Benefits On Insurance Policies Cheap Term Life Insurance

Ppt Group Insurance Life And Disability Benefits Powerpoint

Ppt Group Insurance Life And Disability Benefits Powerpoint

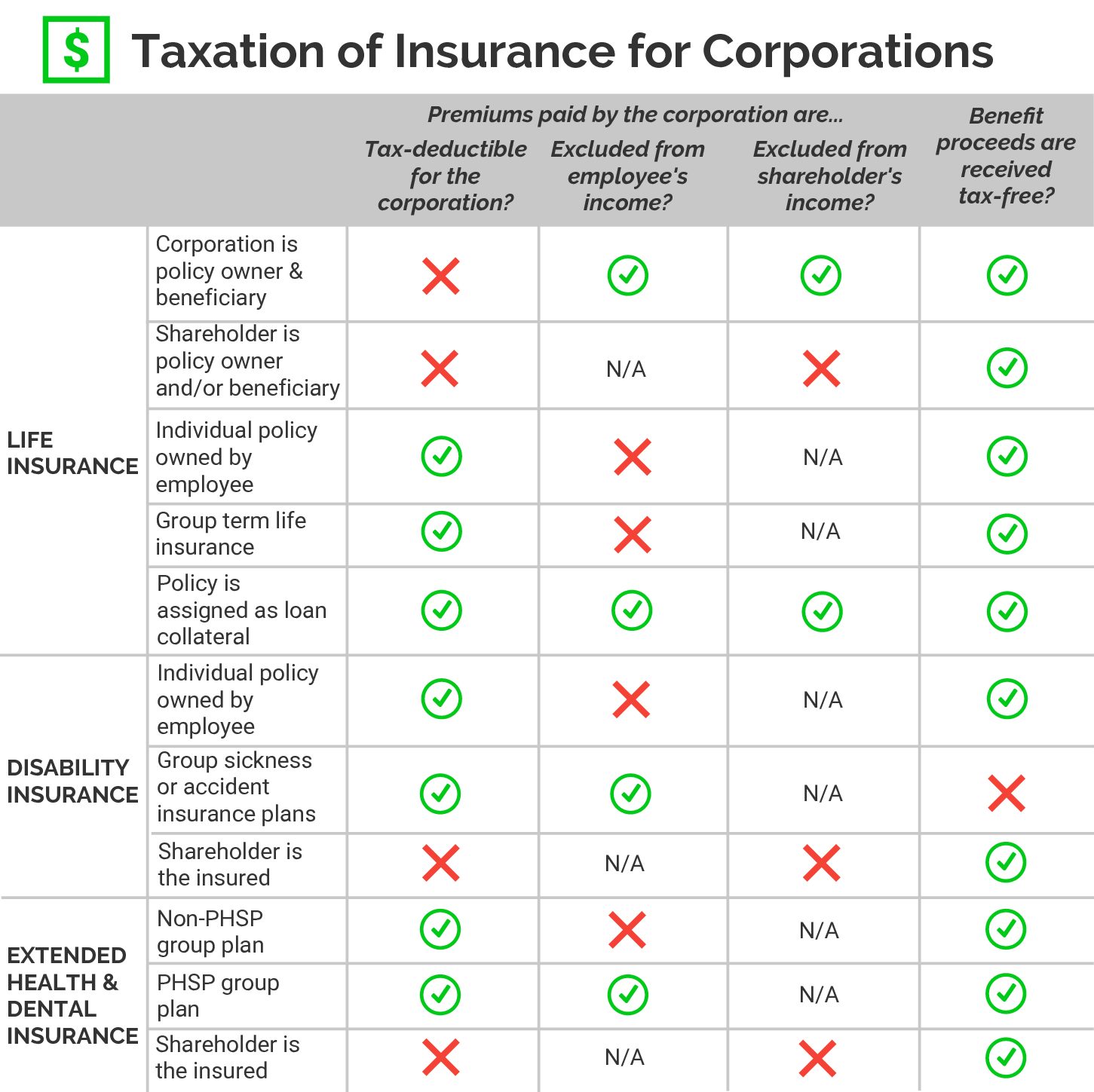

Taxation Of Insurance For Corporations Kelowna Accounting Solutions

Taxation Of Insurance For Corporations Kelowna Accounting Solutions

An Introduction To Cafeteria Plans Permitted Tax Exempt And

An Introduction To Cafeteria Plans Permitted Tax Exempt And

Health Insurance Tax Deductions Save Money Do You Qualify

Health Insurance Tax Deductions Save Money Do You Qualify

Life Insurance Taxation And Benefits Life Insurance

Life Insurance Taxation And Benefits Life Insurance

Taxable Benefits Taxable Benefits Life Insurance Premiums

Taxable Benefits Taxable Benefits Life Insurance Premiums

Whole Life Insurance Cash Value Chart

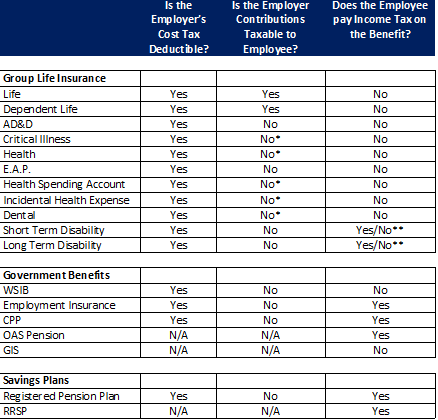

Taxability Status Of Premiums And Benefits Jpbascom Insurance

Taxability Status Of Premiums And Benefits Jpbascom Insurance

Comments

Post a Comment