California has neither an estate tax nor an inheritance tax and as is usually the case life insurance proceeds are not subject to income tax unless the policy is held within a plan where premiums have been deducted from income ie. Whether or not the proceeds of a life insurance policy will be taxable in the state of california will depend on how the policy was written.

Corporate Life Insurance Opportunities To Die For

Corporate Life Insurance Opportunities To Die For

Generally life insurance benefits are not taxable to the beneficiaries except when they become part of an estate and the estate is large enough to be taxable.

Is life insurance taxable in california. If youre reading this youre probably a beneficiary of someones life insurance policy. There is usually no income tax paid on life insurance benefits in any state including california. If you have employer provided life insurance known as group life insurance any coverage over 50000 is treated as taxable income but any amount under 50000 is not taxed.

Life insurance coverage is paid to an insurance company in the form of premium payments over time. Life insurance is almost always not taxable. For example if a business buys a life insurance policy for an employee the employee owns the policy and the business pays the premiums as a bonus the premiums paid would be considered taxable income to the employee.

Life insurance or annuity information is also available on the internet. No life insurance is not taxable in the state of california. Some policies will pay directly into the estate of the deceased while other policies will pay direct to beneficiaries and still others will deposit the proceeds into a trust fund or other type of managed account.

Therefore its not taxable. After death the benefit amount is paid to the beneficiary in the form of a lump sum. Group life insurance can be a nice addition to your benefits package especially if its free or nearly free.

The irs spells it out. If the beneficiary takes the death benefit in installments the interest only is taxable. In addition any interest paid on the benefits is also taxable.

Estate taxes are paid on life insurance if applicable. But when life insurance gets mixed with business sometimes it can have tax implications. Life insurance proceeds are typically not taxable as income but there are several cases in which a life insurance death benefit or policy benefits would be taxed.

Learn whether youll have to pay taxes on life insurance. Life insurance is a way for your loved ones to make sure that youll be financially secure if they pass away. If the beneficiary is a person life insurance bypasses probate.

Generally life insurance proceeds you receive as a beneficiary due to the death of the insured person arent includable in gross income and you dont have to report them life insurance. Life insurance inside a 401k plan. A life insurance payout isnt considered gross income.

In addition the california department of insurance cdi has a toll free hotline telephone number and website that can provide further information and assistance on life insurance policies and annuity contracts.

Understanding Your W 2 Controller S Office

Understanding Your W 2 Controller S Office

California Teachers May Need Help To Avoid Retirement Savings

California Teachers May Need Help To Avoid Retirement Savings

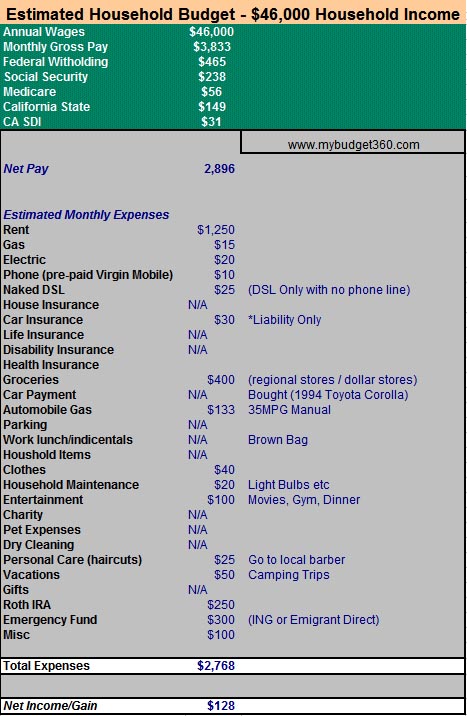

The Perfect 46 000 Budget Learning To Live In California For

The Perfect 46 000 Budget Learning To Live In California For

Facts To Know About California Inheritance Laws A People S Choice

Facts To Know About California Inheritance Laws A People S Choice

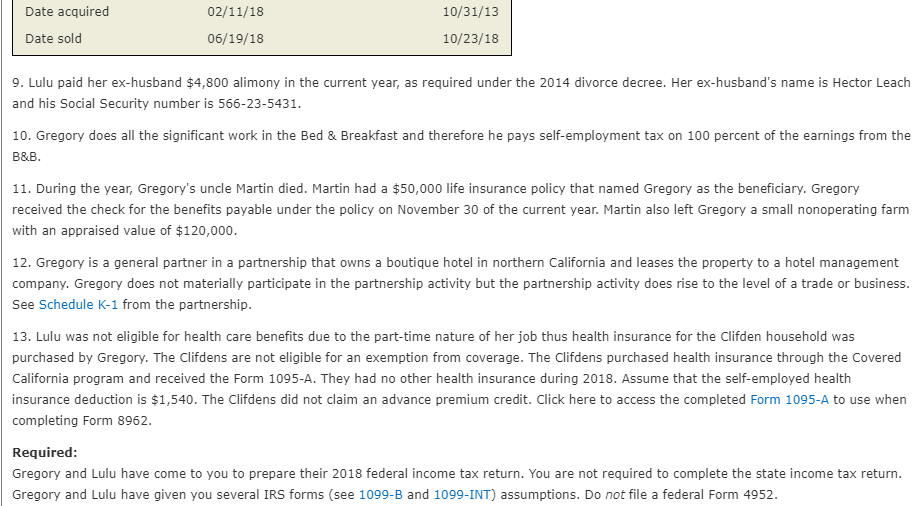

Gregory R And Lulu B Clifden Live With Their Fam Chegg Com

Gregory R And Lulu B Clifden Live With Their Fam Chegg Com

Mange Your Finance With The Help Of Financial Planner In Northern

Mange Your Finance With The Help Of Financial Planner In Northern

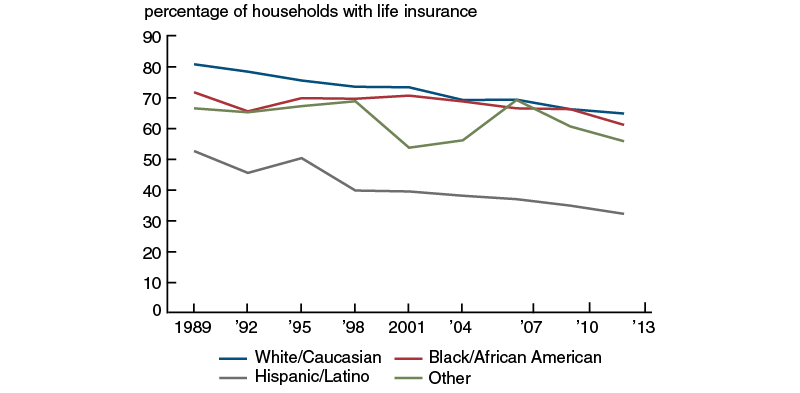

What Explains The Decline In Life Insurance Ownership Federal

What Explains The Decline In Life Insurance Ownership Federal

Federal Taxation Of Life Insurance Companies A Paper Read At The

Federal Taxation Of Life Insurance Companies A Paper Read At The

Can I Sell My Life Insurance Policy All For Cash Mason Finance

Can I Sell My Life Insurance Policy All For Cash Mason Finance

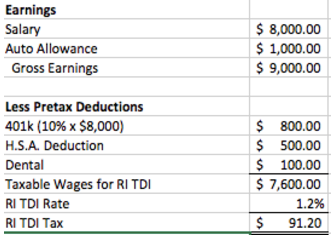

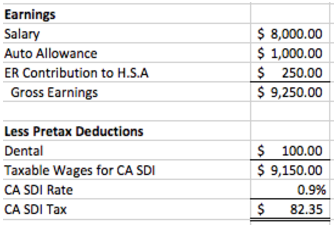

How Are State Disability Insurance Sdi Payroll Taxes Calculated

How Are State Disability Insurance Sdi Payroll Taxes Calculated

Igor A Zey Msfs Cfp Clu Chfc Cap Aep Pdf Free Download

Igor A Zey Msfs Cfp Clu Chfc Cap Aep Pdf Free Download

California Payroll Tax Breaking Down The Basics Squar Milner

California Payroll Tax Breaking Down The Basics Squar Milner

Life Insurance You Could Put To Use Now State Farm

Life Insurance You Could Put To Use Now State Farm

Understanding Your Pay Statement Office Of Human Resources

Understanding Your Pay Statement Office Of Human Resources

Is Shipping In California Taxable

Is Shipping In California Taxable

State Local Tax Update California Selectively Conforms To

State Local Tax Update California Selectively Conforms To

How Are State Disability Insurance Sdi Payroll Taxes Calculated

How Are State Disability Insurance Sdi Payroll Taxes Calculated

1099 Workers Vs W 2 Employees In California A Legal Guide 2019

Why Whole Life Insurance Is A Bad Investment Mom And Dad Money

Why Whole Life Insurance Is A Bad Investment Mom And Dad Money

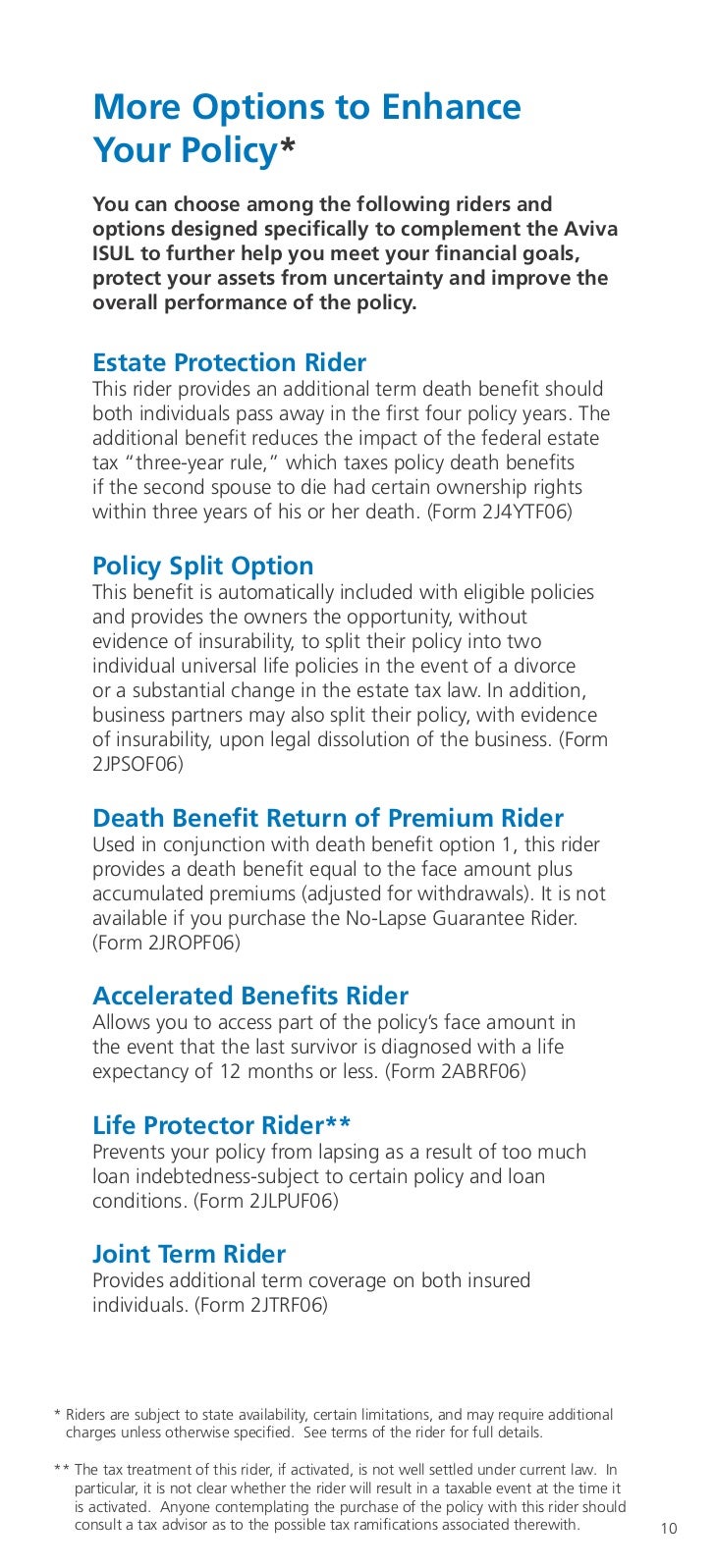

Survivor Universal Life Insurance 4088541883 San Jose California Conn

Survivor Universal Life Insurance 4088541883 San Jose California Conn

Top 10 Best Dividend Paying Whole Life Insurance Companies 2020

Top 10 Best Dividend Paying Whole Life Insurance Companies 2020

Irs California Fee Spat Means Some Tax Liens Go Unrecorded In

Irs California Fee Spat Means Some Tax Liens Go Unrecorded In

Comments

Post a Comment